Increasing Demand for Surgical Efficiency

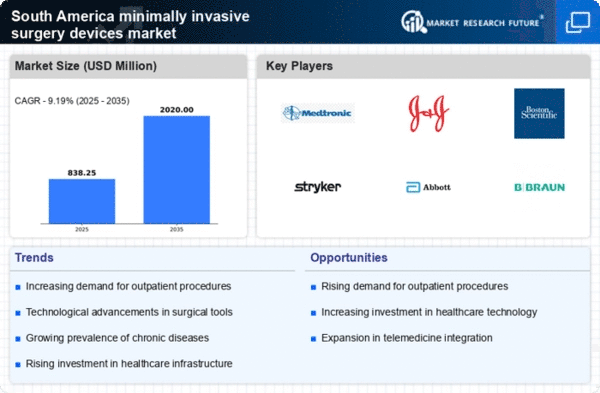

the growing emphasis on surgical efficiency is a pivotal driver in the minimally invasive surgery devices market. Surgeons and healthcare facilities in South America are increasingly adopting minimally invasive techniques to reduce operation times and enhance patient outcomes. This shift is evidenced by a reported increase in the use of laparoscopic procedures, which have shown to decrease recovery times by up to 50%. As hospitals strive to optimize their surgical workflows, the demand for advanced minimally invasive devices is likely to rise. Furthermore, the economic benefits associated with shorter hospital stays and reduced complication rates are compelling healthcare providers to invest in these technologies, thereby propelling the market forward.

Aging Population and Rising Chronic Diseases

the demographic shift towards an aging population in South America is significantly impacting the minimally invasive surgery devices market. As individuals age, the prevalence of chronic diseases such as cardiovascular conditions, diabetes, and obesity increases, necessitating surgical interventions. According to recent statistics, approximately 20% of the population in South America is over 60 years old, a figure that is projected to rise. This demographic trend is likely to drive the demand for minimally invasive surgical procedures, as they are often preferred for their reduced recovery times and lower risk of complications. Consequently, healthcare providers are expected to expand their offerings of minimally invasive devices to cater to this growing patient population.

Growing Investment in Healthcare Infrastructure

the increasing investment in healthcare infrastructure across South America is a vital driver for the minimally invasive surgery devices market. Governments and private entities are channeling funds into upgrading medical facilities and expanding access to advanced surgical technologies. This trend is particularly evident in urban areas, where new hospitals and surgical centers are being established. Enhanced infrastructure not only facilitates the adoption of minimally invasive techniques but also improves patient access to these services. As a result, the market for minimally invasive devices is expected to flourish, driven by the growing availability of state-of-the-art surgical facilities.

Technological Integration in Healthcare Systems

the integration of advanced technologies into healthcare systems is a crucial driver for the minimally invasive surgery devices market. Innovations such as robotic-assisted surgery and enhanced imaging techniques are transforming surgical practices across South America. These technologies not only improve precision and control during procedures but also enhance the overall surgical experience for patients. For instance, robotic systems have been shown to increase the accuracy of surgical interventions, leading to better patient outcomes. As healthcare facilities continue to adopt these technologies, the demand for minimally invasive devices is anticipated to grow, reflecting a broader trend towards modernization in surgical practices.

Cost-Effectiveness of Minimally Invasive Procedures

the cost-effectiveness associated with minimally invasive procedures is a significant driver. These procedures typically result in lower overall healthcare costs due to reduced hospital stays and fewer complications. In South America, healthcare systems are increasingly recognizing the financial benefits of adopting minimally invasive techniques. Studies indicate that hospitals can save up to 30% on costs related to surgical interventions when utilizing these methods. As healthcare providers seek to optimize their budgets while maintaining high-quality care, the demand for minimally invasive-surgery-devices is likely to increase, further solidifying their role in the surgical landscape.