Aging Population and Increased Surgical Needs

The aging population in the UK is a significant driver of the minimally invasive-surgery-devices market. As individuals age, they often experience a higher incidence of chronic diseases that require surgical intervention. The Office for National Statistics (ONS) indicates that the proportion of individuals aged 65 and over is expected to rise to 23% by 2030. This demographic shift is likely to increase the demand for surgical procedures, particularly those that can be performed using minimally invasive techniques. Consequently, healthcare providers are expected to invest more in surgical devices that cater to this growing patient population, thereby driving market expansion.

Technological Innovations in Surgical Devices

Technological innovations play a crucial role in shaping the minimally invasive-surgery-devices market. The introduction of advanced robotic systems and enhanced imaging technologies has revolutionized surgical procedures, allowing for greater precision and control. In the UK, hospitals are increasingly investing in these cutting-edge technologies to improve patient outcomes. For instance, the integration of augmented reality in surgical planning is gaining traction, potentially leading to more efficient surgeries. The market for robotic-assisted surgical devices alone is projected to reach £1.5 billion by 2026, indicating a robust growth trajectory driven by technological advancements. This trend suggests that ongoing innovation will continue to be a significant driver in the market.

Increased Focus on Patient Safety and Outcomes

The heightened focus on patient safety and outcomes is a driving force in the minimally invasive-surgery-devices market. With the growing emphasis on quality of care, healthcare providers are increasingly adopting minimally invasive techniques that are associated with lower complication rates and improved recovery times. Regulatory bodies in the UK are also advocating for practices that enhance patient safety, which aligns with the benefits of minimally invasive surgeries. As a result, hospitals are more likely to invest in advanced surgical devices that support these practices. This focus on safety and outcomes is expected to propel the market forward, as both patients and providers prioritize effective and safe surgical options.

Rising Demand for Minimally Invasive Procedures

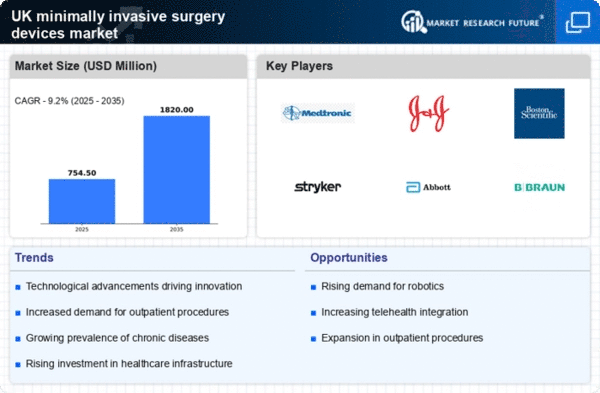

The increasing demand for minimally invasive procedures is a primary driver of the minimally invasive-surgery-devices market. Patients are increasingly opting for these procedures due to their associated benefits, such as reduced recovery times and lower risk of complications. In the UK, the National Health Service (NHS) has reported a rise in the number of laparoscopic surgeries, which are a key component of minimally invasive techniques. This trend is expected to continue, with projections indicating that the market could grow at a CAGR of approximately 8% over the next five years. As more healthcare providers adopt these techniques, the demand for advanced surgical devices is likely to escalate, further propelling market growth.

Cost-Effectiveness of Minimally Invasive Techniques

The cost-effectiveness of minimally invasive techniques is an essential driver for the minimally invasive-surgery-devices market. These procedures often result in shorter hospital stays and quicker recovery times, which can lead to reduced overall healthcare costs. In the UK, studies have shown that laparoscopic surgeries can save the NHS significant amounts in postoperative care. As healthcare systems continue to seek ways to optimize costs while maintaining quality care, the adoption of minimally invasive techniques is likely to increase. This trend suggests that the market for surgical devices will continue to expand as healthcare providers recognize the financial benefits associated with these procedures.