Growing Surgical Procedures

The surge in surgical procedures across South America is significantly impacting the medical tape market. As surgical techniques advance and become more prevalent, the need for reliable and effective medical tapes is becoming increasingly critical. Data suggests that the number of surgical procedures in the region has risen by approximately 7% annually, driven by factors such as an aging population and the prevalence of chronic diseases. This trend indicates a growing market for medical tapes, as they are essential for securing dressings, managing wounds, and supporting surgical sites. The medical tape market is likely to see substantial growth as healthcare providers prioritize the use of high-quality tapes to ensure optimal patient outcomes during and after surgeries.

Increasing Healthcare Expenditure

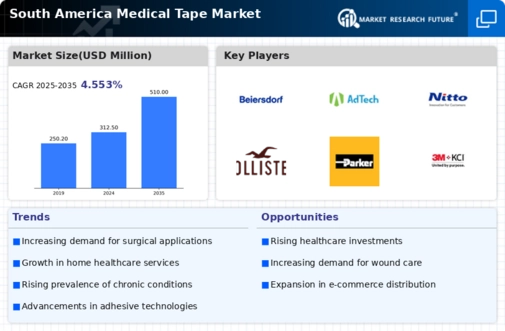

The rising healthcare expenditure in South America is a pivotal driver for the medical tape market. Governments and private sectors are investing more in healthcare infrastructure, which includes hospitals and clinics. This increase in funding is likely to enhance the availability of advanced medical supplies, including medical tapes. According to recent data, healthcare spending in South America is projected to grow at a CAGR of approximately 5.5% over the next few years. This growth indicates a robust demand for medical tape products, as healthcare facilities seek to improve patient care and treatment outcomes. Consequently, the medical tape market is expected to benefit from this upward trend in healthcare investment, leading to increased sales and innovation in product offerings.

Rising Awareness of Patient Safety

There is a notable increase in awareness regarding patient safety in South America, which is influencing the medical tape market. Healthcare providers are increasingly focusing on minimizing risks associated with wound care and surgical procedures. This heightened awareness is leading to the adoption of high-quality medical tapes that ensure secure adhesion and reduce the likelihood of complications. Reports indicate that hospitals are investing more in training staff on best practices for wound management, which includes the proper use of medical tapes. As a result, the demand for specialized medical tapes that enhance patient safety is expected to rise, thereby driving growth in the medical tape market.

Expansion of E-commerce in Healthcare

The expansion of e-commerce platforms in the healthcare sector is emerging as a significant driver for the medical tape market in South America. With the increasing penetration of the internet and mobile devices, healthcare providers and consumers are turning to online platforms for purchasing medical supplies. This shift is facilitating easier access to a variety of medical tape products, including specialized and hard-to-find items. Data indicates that online sales of medical supplies are expected to grow by approximately 15% annually in the region. This trend is likely to enhance market reach and visibility for medical tape manufacturers, ultimately contributing to the growth of the medical tape market.

Technological Advancements in Medical Tapes

Technological advancements are playing a crucial role in shaping the medical tape market in South America. Innovations in materials and adhesive technologies are leading to the development of more effective and versatile medical tapes. For instance, the introduction of hypoallergenic and breathable tapes is addressing the needs of patients with sensitive skin. Furthermore, the integration of antimicrobial properties in medical tapes is becoming increasingly popular, as it helps in preventing infections. The market is witnessing a shift towards these advanced products, which are likely to command higher prices and margins. As a result, the medical tape market is expected to experience growth driven by these technological innovations.