Increasing Surgical Procedures

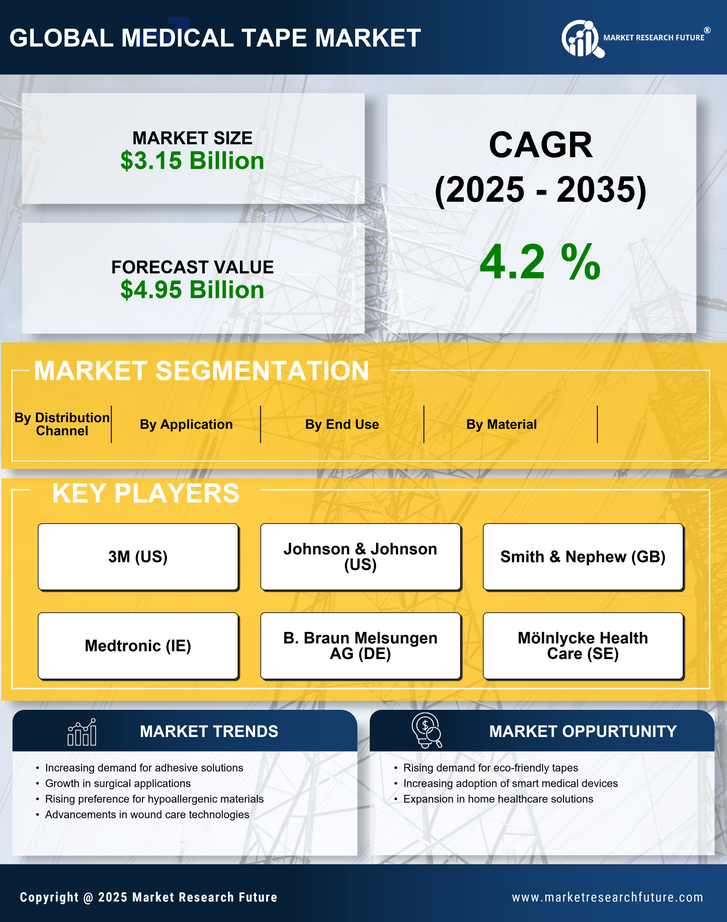

The rising number of surgical procedures worldwide is a critical driver for the Medical Tape Market. As surgical techniques advance and become more accessible, the volume of surgeries performed continues to increase. This trend necessitates the use of medical tapes for securing dressings, managing incisions, and supporting post-operative care. Data suggests that the surgical tape segment within the Medical Tape Market is experiencing significant growth, driven by the demand for reliable and effective products that enhance surgical outcomes. Consequently, the Medical Tape Market is likely to expand in response to the growing surgical landscape, as healthcare facilities prioritize the use of high-quality medical tapes.

Rising Incidence of Chronic Diseases

The increasing prevalence of chronic diseases such as diabetes and cardiovascular conditions is a notable driver for the Medical Tape Market. As these conditions often require regular monitoring and treatment, the demand for medical tapes that facilitate wound care and secure medical devices is likely to rise. According to recent data, the number of individuals diagnosed with chronic diseases continues to grow, leading to a heightened need for effective medical supplies. This trend suggests that healthcare providers are increasingly relying on medical tapes to ensure patient safety and comfort during treatment. Consequently, the Medical Tape Market is expected to experience substantial growth as healthcare systems adapt to the rising demand for chronic disease management.

Expansion of Home Healthcare Services

The expansion of home healthcare services is significantly influencing the Medical Tape Market. As more patients opt for home-based care, the need for medical supplies, including medical tapes, is likely to increase. This shift towards home healthcare is driven by factors such as cost-effectiveness and patient preference for receiving care in familiar environments. Data indicates that the home healthcare market is projected to grow at a robust rate, which in turn suggests a corresponding rise in the demand for medical tapes used in various applications, from wound care to securing medical devices. The Medical Tape Market is poised to benefit from this trend as healthcare providers seek reliable solutions for home care.

Regulatory Support for Medical Devices

Regulatory support for medical devices is playing a pivotal role in shaping the Medical Tape Market. Governments and health authorities are increasingly implementing regulations that promote the safety and efficacy of medical products, including medical tapes. This regulatory framework encourages manufacturers to innovate and improve their offerings, ensuring that medical tapes meet stringent quality standards. As a result, the Medical Tape Market is likely to benefit from enhanced consumer confidence and increased adoption of medical tapes in various healthcare settings. The alignment of industry practices with regulatory requirements suggests a positive outlook for the Medical Tape Market as it adapts to evolving standards.

Technological Innovations in Medical Tapes

Technological innovations in the production and application of medical tapes are emerging as a key driver for the Medical Tape Market. Advances in materials science have led to the development of tapes that are more adhesive, breathable, and hypoallergenic, enhancing patient comfort and safety. Furthermore, the integration of smart technologies into medical tapes, such as sensors that monitor wound healing, is gaining traction. This evolution in product offerings is likely to attract healthcare professionals seeking effective solutions for patient care. As a result, the Medical Tape Market is expected to witness growth fueled by these innovations, which cater to the evolving needs of healthcare providers and patients alike.