Aging Population

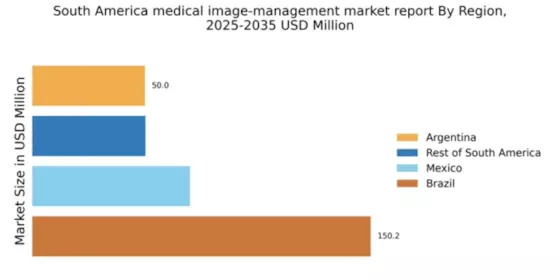

The demographic shift towards an aging population in South America is significantly influencing the medical image-management market. As the population ages, the prevalence of chronic diseases and conditions requiring advanced imaging increases. For example, by 2025, it is projected that over 15% of the population in countries like Argentina and Chile will be over 65 years old. This demographic trend necessitates enhanced imaging services to facilitate early diagnosis and treatment of age-related health issues. Consequently, healthcare providers are likely to invest in medical image-management technologies to cater to this growing demand. The aging population not only drives the need for more imaging services but also encourages the development of innovative solutions tailored to the specific needs of older patients, thereby propelling the market forward.

Integration of AI in Imaging

The integration of artificial intelligence (AI) in medical imaging is emerging as a transformative driver for the medical image-management market in South America. AI technologies enhance image analysis, improve diagnostic accuracy, and streamline workflows. For instance, AI algorithms can reduce the time radiologists spend on image interpretation, potentially increasing efficiency by up to 30%. As healthcare facilities seek to optimize operations and improve patient care, the adoption of AI-driven imaging solutions is likely to accelerate. This trend is particularly relevant in urban areas where healthcare demands are high. The medical image-management market is expected to benefit from this technological evolution, as AI not only enhances existing imaging capabilities but also opens avenues for new applications in diagnostics and treatment planning.

Rising Healthcare Expenditure

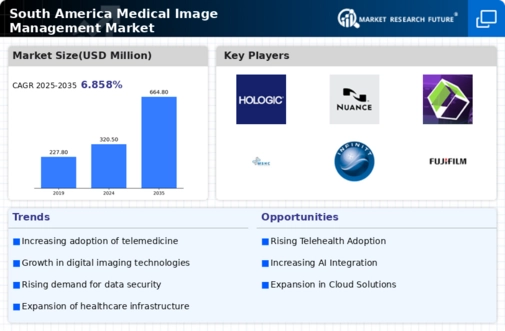

The increasing healthcare expenditure in South America is a pivotal driver for the medical image-management market. Governments and private sectors are allocating more funds towards healthcare infrastructure, which includes advanced imaging technologies. For instance, Brazil's healthcare spending reached approximately $200 billion in 2023, indicating a growing commitment to enhancing medical services. This financial support is likely to facilitate the adoption of sophisticated imaging systems, thereby improving diagnostic accuracy and patient outcomes. As healthcare budgets expand, hospitals and clinics are more inclined to invest in medical image-management solutions, which are essential for efficient patient care. The trend suggests that as healthcare expenditure continues to rise, the medical image-management market will experience substantial growth, driven by the need for improved imaging capabilities and better resource management.

Expansion of Healthcare Infrastructure

The expansion of healthcare infrastructure across South America is a significant driver for the medical image-management market. Governments are investing in new hospitals and clinics, particularly in underserved regions, to improve access to healthcare services. This expansion is accompanied by the need for modern imaging technologies to support diagnostic and treatment processes. For example, Brazil's initiative to build over 100 new healthcare facilities by 2025 is expected to create substantial demand for medical imaging equipment and management systems. As these facilities become operational, the medical image-management market is likely to see increased adoption of advanced imaging solutions. This trend indicates a robust growth trajectory, as enhanced infrastructure directly correlates with the need for efficient and effective medical image management.

Growing Focus on Preventive Healthcare

The growing emphasis on preventive healthcare in South America is a crucial driver for the medical image-management market. As awareness of health issues increases, more individuals are seeking regular check-ups and screenings, which often involve imaging procedures. This shift towards preventive measures is reflected in the rising number of imaging studies conducted annually. For instance, it is estimated that the demand for preventive imaging services could increase by 20% over the next five years. Healthcare providers are responding by investing in advanced medical image-management systems to accommodate this rising demand. The focus on preventive healthcare not only enhances patient outcomes but also drives the need for efficient image management solutions, thereby fostering growth in the medical image-management market.