Growing Pharmaceutical Sector

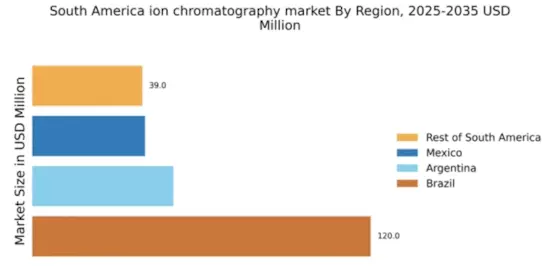

The pharmaceutical sector in South America is witnessing robust growth, which is positively impacting the ion chromatography market. As the demand for high-quality pharmaceuticals increases, the need for precise analytical methods becomes paramount. Ion chromatography is essential for the analysis of active pharmaceutical ingredients (APIs) and impurities, ensuring product safety and efficacy. The market for ion chromatography in this sector is expected to grow significantly, driven by the increasing number of drug approvals and the expansion of pharmaceutical manufacturing facilities in countries like Brazil and Argentina. In 2024, the pharmaceutical market in South America is projected to reach $50 billion, further boosting the demand for ion chromatography systems.

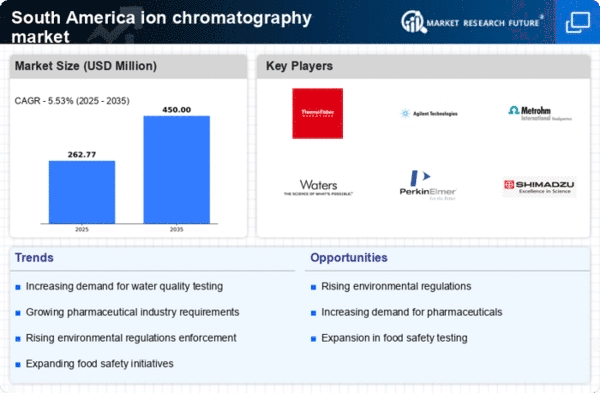

Increasing Regulatory Standards

The ion chromatography market in South America is experiencing growth due to the increasing regulatory standards imposed by governmental bodies. These regulations often require stringent testing of water, soil, and food products for contaminants. As a result, industries such as pharmaceuticals, food and beverage, and environmental monitoring are compelled to adopt advanced analytical techniques, including ion chromatography. The market is projected to expand as companies invest in compliance with these regulations, which may lead to a rise in demand for ion chromatography systems. In 2023, the market size for ion chromatography in South America was estimated at approximately $150 million, with expectations of a CAGR of around 8% over the next five years.

Rising Awareness of Water Quality

In South America, there is a growing awareness regarding water quality and its implications for public health. This awareness is driving the ion chromatography market as municipalities and industries seek reliable methods for monitoring water contaminants. Ion chromatography provides accurate analysis of anions and cations in water samples, making it a preferred choice for environmental testing laboratories. The increasing investment in water treatment facilities and environmental protection initiatives is likely to enhance the demand for ion chromatography systems. In 2025, the water quality testing market in South America is anticipated to exceed $1 billion, with ion chromatography playing a crucial role in meeting testing requirements.

Expansion of Research and Development Activities

The expansion of research and development (R&D) activities in South America is fostering growth in the ion chromatography market. Academic institutions and research organizations are increasingly utilizing ion chromatography for various applications, including environmental studies and material science. This trend is likely to drive demand for ion chromatography systems as researchers seek reliable and efficient analytical methods. Furthermore, government funding for scientific research is expected to increase, providing additional support for the acquisition of advanced analytical equipment. In 2025, R&D spending in South America is projected to reach $10 billion, which may further stimulate the growth of the ion chromatography market.

Technological Innovations in Analytical Chemistry

Technological innovations in analytical chemistry are significantly influencing the ion chromatography market in South America. The introduction of advanced ion chromatography systems, featuring enhanced sensitivity and automation, is attracting various industries. These innovations facilitate faster and more accurate analyses, which are essential for sectors such as food safety and environmental monitoring. As companies strive to improve operational efficiency and reduce costs, the adoption of these advanced systems is likely to increase. The market for analytical instruments in South America is projected to grow at a CAGR of 7% from 2025 to 2030, with ion chromatography being a key contributor to this growth.