Focus on Energy Efficiency

The industrial lubricants market is increasingly influenced by the focus on energy efficiency among manufacturers. Companies are seeking ways to reduce energy consumption and operational costs, leading to a growing demand for lubricants that enhance machinery efficiency. In South America, the push for energy-efficient solutions is evident, with many industries adopting advanced lubrication technologies. This trend is expected to grow, as businesses recognize the potential for cost savings and improved performance. By 2025, it is projected that energy-efficient lubricants could account for over 25% of the total lubricant market in the region, indicating a significant shift towards sustainable practices within the industrial lubricants market.

Rising Industrial Production

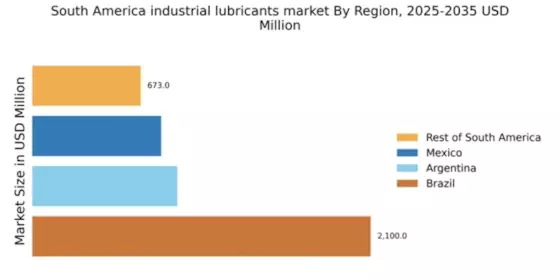

The industrial lubricants market in South America is experiencing growth due to the rising industrial production across various sectors. Countries like Brazil and Argentina are witnessing an increase in manufacturing activities, which drives the demand for lubricants. The industrial lubricants market is expected to benefit from this trend, as lubricants are essential for machinery operation and maintenance. In 2025, the manufacturing sector in Brazil is projected to grow by approximately 3.5%, leading to a corresponding increase in lubricant consumption. This growth is likely to enhance the overall market dynamics, as industries seek to optimize performance and reduce downtime through effective lubrication solutions.

Expansion of Automotive Sector

The automotive sector in South America is expanding, which significantly impacts the industrial lubricants market. With increasing vehicle production and sales, the demand for high-performance lubricants is on the rise. In 2025, the automotive production in South America is anticipated to reach around 3 million units, creating a substantial market for lubricants. This growth is driven by both domestic consumption and export opportunities. As automotive manufacturers focus on enhancing engine efficiency and longevity, the need for advanced lubricants becomes critical. Consequently, this expansion is likely to propel the industrial lubricants market, as companies strive to meet the evolving requirements of the automotive industry.

Infrastructure Development Projects

Infrastructure development projects across South America are contributing to the growth of the industrial lubricants market. Governments are investing heavily in transportation, energy, and construction projects, which require reliable lubrication solutions for machinery and equipment. In 2025, it is estimated that infrastructure spending in the region will exceed $200 billion, creating a robust demand for industrial lubricants. This investment not only supports economic growth but also enhances the operational efficiency of construction and heavy machinery. As a result, the industrial lubricants market is likely to see increased consumption driven by the need for high-quality lubricants that can withstand demanding operational conditions.

Technological Innovations in Lubricants

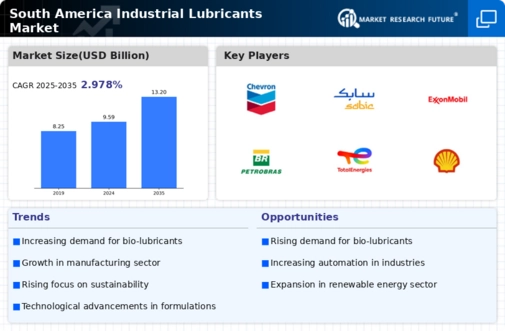

Technological innovations are playing a crucial role in shaping the industrial lubricants market in South America. The development of synthetic and bio-based lubricants is gaining traction, as these products offer superior performance and environmental benefits. In 2025, the market for synthetic lubricants is expected to grow by approximately 15%, driven by their ability to provide better protection and efficiency. This shift towards advanced lubricant formulations is likely to enhance the competitive landscape, as manufacturers strive to meet the evolving needs of various industries. As a result, the industrial lubricants market is poised for transformation, with innovations leading to improved product offerings and increased market penetration.