Increasing Aging Population

The aging population in South America is a crucial driver for the hospital bed market. As the demographic shifts towards an older age group, the demand for healthcare services, including hospital beds, is likely to rise. By 2030, it is projected that individuals aged 60 and above will constitute approximately 20% of the total population in several South American countries. This demographic trend necessitates the expansion of healthcare facilities and the procurement of specialized hospital beds to cater to the needs of elderly patients. The hospital bed market must adapt to this growing demand by offering beds that provide comfort and support for age-related health issues, thereby enhancing patient care and recovery outcomes.

Government Healthcare Initiatives

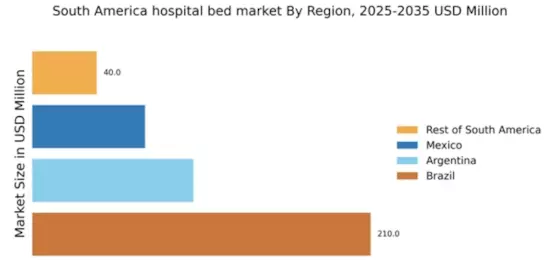

Government initiatives aimed at improving healthcare infrastructure in South America are significantly influencing the hospital bed market. Various countries in the region are investing in healthcare reforms to enhance access to medical services. For instance, Brazil's government has allocated over $1 billion to upgrade hospital facilities, which includes the procurement of modern hospital beds. Such initiatives not only improve the quality of care but also stimulate the hospital bed market by creating opportunities for manufacturers and suppliers. The focus on expanding healthcare access is expected to drive the demand for hospital beds, particularly in rural and underserved areas, where the need for adequate medical facilities is most pressing.

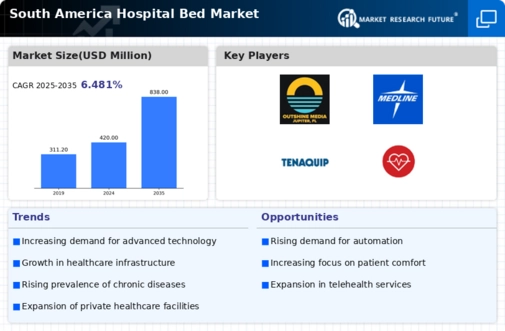

Rising Prevalence of Chronic Diseases

The increasing prevalence of chronic diseases in South America is a significant factor driving the hospital bed market. Conditions such as diabetes, cardiovascular diseases, and respiratory disorders are becoming more common, necessitating prolonged hospital stays and specialized care. According to health statistics, chronic diseases account for nearly 70% of all deaths in the region, highlighting the urgent need for adequate healthcare resources. This trend compels healthcare providers to invest in hospital beds that cater to the specific needs of patients with chronic conditions. The hospital bed market must respond by developing beds equipped with advanced features that facilitate better monitoring and treatment of these patients, thereby improving overall healthcare outcomes.

Technological Integration in Healthcare

The integration of advanced technologies in healthcare is reshaping the hospital bed market in South America. Innovations such as smart beds equipped with monitoring systems and adjustable features are becoming increasingly popular. These beds not only enhance patient comfort but also improve the efficiency of healthcare delivery. The hospital bed market is witnessing a shift towards beds that incorporate technology for better patient management, including remote monitoring capabilities. As hospitals strive to enhance operational efficiency and patient care, the demand for technologically advanced hospital beds is expected to grow. This trend indicates a potential for increased investment in research and development within the industry to meet evolving healthcare needs.

Expansion of Private Healthcare Facilities

The expansion of private healthcare facilities in South America is a notable driver for the hospital bed market. As more individuals seek private healthcare services for quicker access and better quality, the demand for hospital beds in these facilities is likely to increase. The private sector is investing heavily in modernizing healthcare infrastructure, with estimates suggesting that private healthcare spending could reach $100 billion by 2027. This growth presents opportunities for the hospital bed market to supply innovative and high-quality beds tailored to the needs of private hospitals. The competitive landscape in the private sector may further stimulate advancements in bed technology and design, ultimately benefiting patient care.