Aging Population

The aging population in North America is a crucial driver for the hospital bed market. As the demographic shifts towards an older age group, the demand for healthcare services, including hospital beds, is expected to rise significantly. By 2030, it is projected that approximately 20% of the population will be aged 65 and older, leading to an increased need for hospital beds tailored to geriatric care. This demographic trend indicates a growing requirement for specialized hospital beds that cater to the unique needs of elderly patients, such as adjustable features and enhanced comfort. Consequently, the hospital bed market is likely to experience substantial growth as healthcare facilities adapt to accommodate this demographic shift.

Technological Advancements

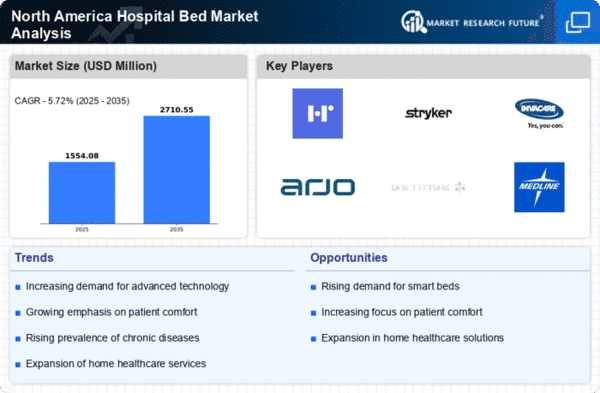

Technological advancements play a pivotal role in shaping the hospital bed market. Innovations such as smart beds equipped with sensors and monitoring systems are becoming increasingly prevalent. These beds can track patient vitals, adjust positions automatically, and enhance overall patient care. The integration of technology not only improves patient outcomes but also streamlines hospital operations. In 2025, it is estimated that the market for smart hospital beds could reach $1.5 billion in North America alone. This surge in demand for technologically advanced hospital beds indicates a shift towards more efficient and effective healthcare delivery, thereby driving the growth of the hospital bed market.

Rising Healthcare Expenditure

Rising healthcare expenditure in North America is a significant driver for the hospital bed market. With healthcare spending projected to reach $4.3 trillion by 2025, hospitals are increasingly investing in modern infrastructure, including advanced hospital beds. This financial commitment reflects a broader trend towards enhancing patient care and improving hospital efficiency. As healthcare facilities allocate more resources to upgrade their equipment, the demand for high-quality hospital beds is expected to rise. This trend suggests that the hospital bed market will continue to expand, driven by the need for improved patient experiences and outcomes.

Increased Focus on Patient Safety

An increased focus on patient safety is emerging as a vital driver in the hospital bed market. Hospitals are prioritizing the implementation of safety features in hospital beds to reduce the risk of falls and enhance patient comfort. Features such as bed alarms, side rails, and pressure-relieving mattresses are becoming standard in modern hospital beds. This emphasis on safety is likely to influence purchasing decisions, as healthcare providers seek to minimize liability and improve patient satisfaction. As a result, the hospital bed market is expected to grow, reflecting the industry's commitment to ensuring patient safety and well-being.

Regulatory Compliance and Standards

Regulatory compliance and standards are critical drivers influencing the hospital bed market. In North America, healthcare facilities must adhere to stringent regulations regarding equipment safety and quality. Compliance with these standards necessitates the procurement of hospital beds that meet specific safety and performance criteria. As regulations evolve, hospitals are compelled to upgrade their equipment to maintain compliance, thereby driving demand for new hospital beds. This trend indicates that the hospital bed market will likely experience growth as healthcare providers invest in compliant and high-quality products to meet regulatory requirements.