Rising Industrial Automation

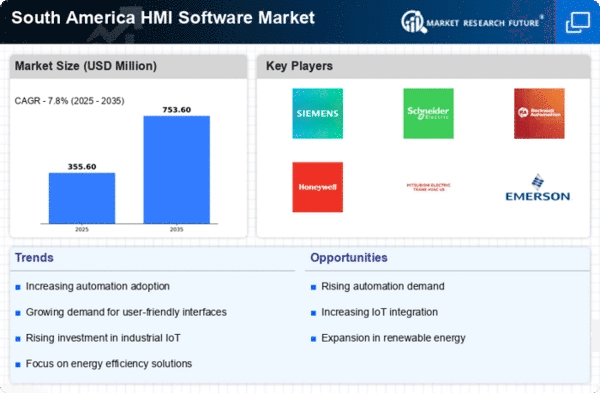

The hmi software market in South America is experiencing a notable surge due to the increasing trend of industrial automation across various sectors. Industries such as manufacturing, oil and gas, and mining are adopting automated processes to enhance efficiency and reduce operational costs. This shift is likely to drive the demand for advanced hmi software solutions that facilitate real-time monitoring and control of industrial processes. According to recent data, the automation market in South America is projected to grow at a CAGR of approximately 8% over the next five years, indicating a robust opportunity for hmi software providers to cater to this expanding market. As companies seek to optimize their operations, the integration of hmi software becomes essential for achieving seamless automation and improved productivity.

Emergence of Smart Manufacturing

The concept of smart manufacturing is gaining traction in South America, significantly impacting the hmi software market. As industries transition towards more intelligent and interconnected manufacturing processes, the demand for sophisticated hmi software solutions is likely to increase. Smart manufacturing emphasizes the use of advanced technologies such as AI, machine learning, and IoT, which require hmi software that can seamlessly integrate with these systems. This shift is expected to enhance operational efficiency, reduce downtime, and improve overall productivity. The hmi software market is poised to benefit from this trend, as manufacturers seek solutions that enable them to harness the full potential of smart technologies. The anticipated growth in smart manufacturing initiatives may lead to a compound annual growth rate of approximately 9% in the hmi software market over the next few years.

Increased Focus on Cybersecurity

As the hmi software market in South America expands, the focus on cybersecurity is becoming increasingly critical. With the rise of interconnected systems and the Internet of Things (IoT), the potential for cyber threats has escalated. Industries are prioritizing the protection of their operational technology (OT) environments, leading to a heightened demand for hmi software that incorporates robust cybersecurity measures. Companies are investing in solutions that not only provide operational efficiency but also ensure the integrity and security of their systems. This trend is likely to drive innovation within the hmi software market, as providers develop solutions that address these security concerns. The market may see a significant shift towards cybersecurity-enhanced hmi software, reflecting the growing awareness of the importance of safeguarding industrial operations.

Growing Demand for Data Analytics

The increasing emphasis on data-driven decision-making is propelling the hmi software market in South America. Companies are recognizing the value of data analytics in optimizing operations and enhancing productivity. Hmi software solutions that incorporate advanced analytics capabilities allow users to visualize and interpret data effectively, leading to informed decision-making. This trend is particularly evident in sectors such as manufacturing and energy, where real-time data analysis is crucial for operational success. The hmi software market is likely to see a rise in demand for solutions that offer robust data analytics features, as organizations strive to leverage data for competitive advantage. As a result, the market is expected to witness a growth rate of around 7% annually, driven by the need for enhanced data utilization.

Government Initiatives and Regulations

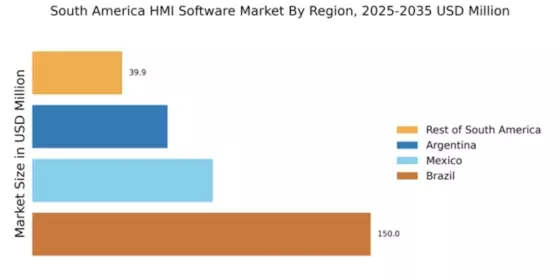

Government initiatives aimed at promoting technological advancements in South America are significantly influencing the hmi software market. Various countries in the region are implementing regulations that encourage the adoption of smart technologies in industries. For instance, Brazil's government has introduced policies to support the modernization of manufacturing processes, which includes the integration of hmi software solutions. These initiatives not only enhance operational efficiency but also align with sustainability goals. The hmi software market stands to benefit from these regulatory frameworks, as they create a conducive environment for innovation and investment. Furthermore, the potential for public-private partnerships in technology development may further stimulate market growth, making it a pivotal driver in the region.