Rising Automation in Industries

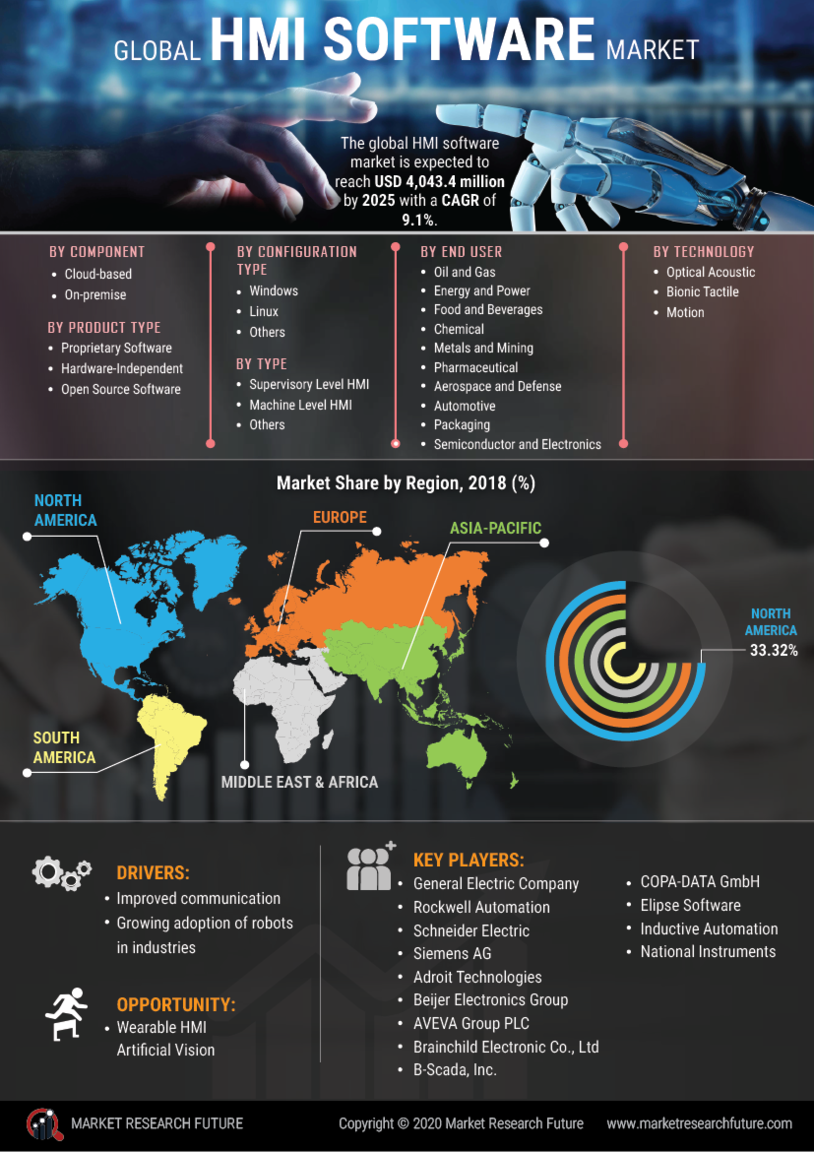

The HMI Software Market is experiencing a notable surge due to the increasing automation across various sectors. Industries such as manufacturing, oil and gas, and automotive are adopting automated processes to enhance efficiency and reduce operational costs. According to recent data, the automation market is projected to grow at a compound annual growth rate of approximately 9% over the next five years. This trend necessitates sophisticated HMI software solutions that facilitate seamless interaction between human operators and machines, thereby driving demand in the HMI Software Market. As organizations strive for operational excellence, the integration of HMI systems becomes crucial, enabling real-time data visualization and control, which ultimately leads to improved productivity and safety.

Advancements in IoT Technologies

The proliferation of Internet of Things (IoT) technologies is significantly influencing the HMI Software Market. As more devices become interconnected, the need for intuitive HMI solutions that can manage and analyze data from these devices is paramount. The IoT market is expected to reach a valuation of over 1 trillion dollars by 2026, indicating a robust growth trajectory. HMI software plays a vital role in this ecosystem by providing user-friendly interfaces that allow operators to monitor and control IoT-enabled devices effectively. This integration not only enhances operational efficiency but also fosters innovation in product development and service delivery within the HMI Software Market. Consequently, companies are increasingly investing in HMI solutions that can leverage IoT capabilities to stay competitive.

Growing Adoption of Cloud-Based Solutions

The shift towards cloud-based solutions is emerging as a significant driver in the HMI Software Market. Organizations are increasingly adopting cloud technologies to enhance flexibility, scalability, and accessibility of HMI systems. The cloud computing market is anticipated to grow at a compound annual growth rate of over 17% in the coming years, reflecting a strong trend towards digital transformation. Cloud-based HMI solutions offer numerous advantages, including reduced infrastructure costs and improved collaboration among teams. Furthermore, these solutions enable remote access to HMI systems, which is particularly beneficial for organizations with multiple locations or those requiring remote monitoring capabilities. As businesses continue to embrace cloud technologies, the demand for cloud-based HMI software is likely to increase, further propelling the HMI Software Market.

Regulatory Compliance and Safety Standards

The HMI Software Market is also driven by the increasing need for regulatory compliance and adherence to safety standards. Industries such as pharmaceuticals, food and beverage, and chemicals are subject to stringent regulations that mandate the implementation of effective monitoring and control systems. HMI software solutions are essential in ensuring compliance with these regulations by providing accurate data logging, reporting, and real-time monitoring capabilities. As regulatory bodies continue to tighten standards, organizations are compelled to invest in HMI systems that can facilitate compliance and enhance safety protocols. This trend is expected to propel the growth of the HMI Software Market, as companies seek to mitigate risks and avoid potential penalties associated with non-compliance.

Emphasis on Data Analytics and Visualization

In the HMI Software Market, there is a growing emphasis on data analytics and visualization capabilities. Organizations are increasingly recognizing the value of data-driven decision-making, which necessitates advanced HMI solutions that can process and present data in a comprehensible manner. The HMI Software Market is projected to grow significantly, with estimates suggesting it could reach 274 billion dollars by 2022. HMI software that incorporates robust analytics features enables users to derive actionable insights from complex data sets, thereby enhancing operational efficiency and strategic planning. This trend is particularly evident in sectors such as manufacturing and energy, where real-time data visualization is critical for optimizing processes and ensuring safety. As a result, the demand for sophisticated HMI solutions that integrate data analytics is likely to rise within the HMI Software Market.