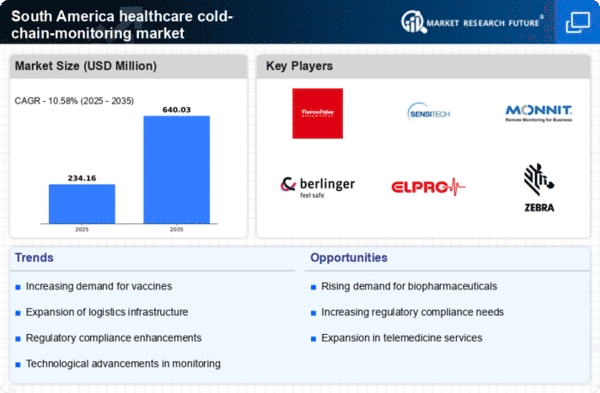

Expansion of Biopharmaceuticals

The biopharmaceutical sector in South America is witnessing rapid growth, which is significantly impacting the healthcare cold-chain-monitoring market. With an estimated CAGR of 12% projected for biopharmaceuticals, the demand for effective cold-chain solutions is likely to increase. These products often require strict temperature controls to maintain their efficacy, necessitating advanced monitoring systems. As companies expand their biopharmaceutical offerings, the healthcare cold-chain-monitoring market must adapt to meet these evolving needs. This expansion not only highlights the importance of reliable cold-chain logistics but also presents opportunities for innovation in monitoring technologies.

Rising E-commerce in Healthcare

The rise of e-commerce in the healthcare sector is transforming the landscape of the healthcare cold-chain-monitoring market in South America. As more consumers turn to online platforms for purchasing medications and health products, the need for efficient cold-chain logistics becomes critical. E-commerce companies are increasingly investing in temperature-controlled storage and transportation solutions to ensure product integrity. This shift is expected to drive growth in the healthcare cold-chain-monitoring market, as businesses seek to implement reliable monitoring systems that can track temperature fluctuations during transit, thereby safeguarding the quality of healthcare products.

Growing Awareness of Vaccine Safety

In South America, there is a heightened awareness regarding the safety and efficacy of vaccines, which is driving the healthcare cold-chain-monitoring market. As vaccination campaigns expand, the need for stringent temperature control during storage and transport becomes paramount. Reports indicate that improper handling can lead to a 30% reduction in vaccine effectiveness. Consequently, healthcare providers are increasingly investing in cold-chain monitoring solutions to ensure compliance with safety standards. This trend is likely to propel the healthcare cold-chain-monitoring market forward, as stakeholders recognize the importance of maintaining the integrity of vaccines throughout the supply chain.

Regulatory Pressure for Quality Assurance

Regulatory bodies in South America are imposing stricter guidelines for the storage and transportation of temperature-sensitive healthcare products. This regulatory pressure is a significant driver for the healthcare cold-chain-monitoring market, as compliance becomes essential for market players. For example, the introduction of new regulations may require companies to implement real-time monitoring systems to ensure adherence to temperature requirements. As a result, the healthcare cold-chain-monitoring market is likely to see increased demand for sophisticated monitoring solutions that can provide detailed compliance reports and enhance overall product safety.

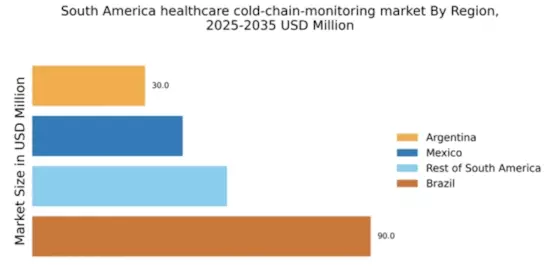

Increasing Investment in Healthcare Infrastructure

The healthcare cold-chain-monitoring market in South America is experiencing a surge in investment aimed at enhancing healthcare infrastructure. Governments and private entities are allocating substantial funds to improve storage and transportation facilities for temperature-sensitive products. For instance, Brazil has seen a 15% increase in healthcare spending, which is likely to bolster the cold-chain systems necessary for vaccines and biologics. This investment is crucial as it supports the establishment of advanced monitoring technologies, ensuring that products remain within required temperature ranges. The healthcare cold-chain-monitoring market is thus positioned to benefit from these infrastructural improvements, which may lead to enhanced efficiency and reliability in the distribution of critical medical supplies.