Rising Healthcare Expenditure

The increase in healthcare expenditure across South America is a crucial driver for the gastritis treatment market. Governments and private sectors are investing more in healthcare infrastructure, which is facilitating better access to medical services and treatments. Reports indicate that healthcare spending in several South American countries has risen by over 15% in recent years, allowing for improved diagnostic and therapeutic options for gastritis. This financial commitment is likely to enhance the availability of treatments, making them more accessible to patients. As a result, the gastritis treatment market is poised for growth, as more individuals seek treatment for their conditions. The increased funding is also encouraging research initiatives aimed at developing new therapies, further propelling market expansion.

Growing Awareness of Gastritis

The growing awareness of gastritis and its implications for health is driving the gastritis treatment market in South America. Educational campaigns by healthcare organizations and government bodies are informing the public about the symptoms and risks associated with gastritis. This heightened awareness is leading to an increase in patient consultations and a subsequent rise in demand for treatment options. Surveys indicate that nearly 40% of individuals in South America are now more informed about gastritis, which is likely to result in earlier diagnosis and intervention. Consequently, healthcare providers are experiencing an uptick in patient inquiries regarding gastritis treatments, thereby stimulating market growth. The gastritis treatment market is expected to benefit from this trend as more patients seek effective solutions for their health concerns.

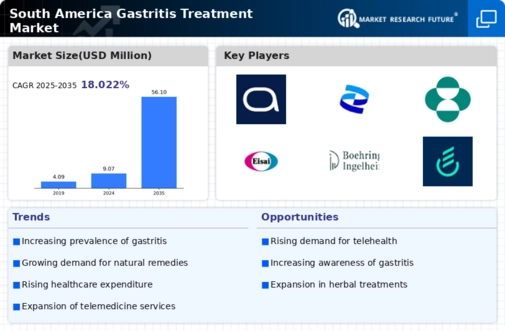

Growing Incidence of Gastritis

The rising incidence of gastritis in South America is a primary driver for the gastritis treatment market. Factors such as dietary habits, increased stress levels, and the prevalence of Helicobacter pylori infections contribute to this trend. Recent studies indicate that approximately 30% of the population in certain South American countries experiences gastritis symptoms, leading to a heightened demand for effective treatment options. This growing patient base is likely to stimulate market growth as healthcare providers seek to address the needs of affected individuals. Furthermore, the increasing awareness of gastritis as a significant health issue is prompting more patients to seek medical advice, thereby expanding the market for gastritis treatments. As a result, pharmaceutical companies and healthcare providers are focusing on developing innovative therapies to cater to this rising demand.

Advancements in Treatment Options

Innovations in treatment options for gastritis are significantly influencing the gastritis treatment market in South America. The development of new medications, including proton pump inhibitors and antibiotics targeting H. pylori, has transformed the management of gastritis. Recent market analyses suggest that the introduction of these advanced therapies has led to a 20% increase in treatment efficacy, thereby improving patient outcomes. Additionally, the emergence of combination therapies is providing healthcare professionals with more effective tools to combat gastritis. This trend is likely to continue as research and development efforts focus on creating more targeted and personalized treatment regimens. Consequently, the gastritis treatment market is expected to expand as healthcare providers adopt these innovative solutions to enhance patient care and satisfaction.

Integration of Telemedicine in Treatment

The integration of telemedicine into healthcare services is emerging as a significant driver for the gastritis treatment market in South America. The convenience and accessibility of telehealth services are enabling patients to consult healthcare professionals without the need for in-person visits. This trend is particularly beneficial for individuals in remote areas where access to specialized care may be limited. Recent data suggests that telemedicine consultations for gastritis have increased by approximately 25% in the past year, reflecting a shift in patient preferences. As telemedicine continues to gain traction, it is likely to enhance patient engagement and adherence to treatment plans. This shift is expected to positively impact the gastritis treatment market, as more patients are likely to seek timely medical advice and treatment through digital platforms.