Growing Awareness of Rare Diseases

There is a rising awareness of rare diseases among both healthcare professionals and the general public in South America, which is positively impacting the esoteric testing market. As more individuals seek diagnoses for uncommon conditions, the demand for specialized testing services has increased. This trend is further supported by initiatives aimed at educating healthcare providers about rare diseases and the importance of early detection. The esoteric testing market is likely to see a corresponding rise in the number of tests conducted for rare diseases, with estimates suggesting a growth of approximately 15% in this segment over the next few years. This heightened awareness not only drives demand but also encourages research and development in the field of esoteric testing, fostering innovation and improved diagnostic capabilities.

Advancements in Laboratory Technology

Technological advancements are significantly influencing the esoteric testing market in South America. Innovations in laboratory equipment and testing methodologies are enhancing the accuracy and efficiency of diagnostic tests. For instance, the introduction of next-generation sequencing (NGS) and mass spectrometry has revolutionized the capabilities of laboratories, allowing for more complex analyses that were previously unattainable. This technological evolution is expected to drive market growth, as healthcare providers increasingly adopt these advanced testing solutions. The esoteric testing market is likely to benefit from these advancements, with an anticipated increase in the number of tests performed annually, potentially reaching over 5 million tests by 2027. This trend underscores the importance of continuous investment in laboratory technology to meet the rising demand for sophisticated diagnostic services.

Increasing Demand for Personalized Medicine

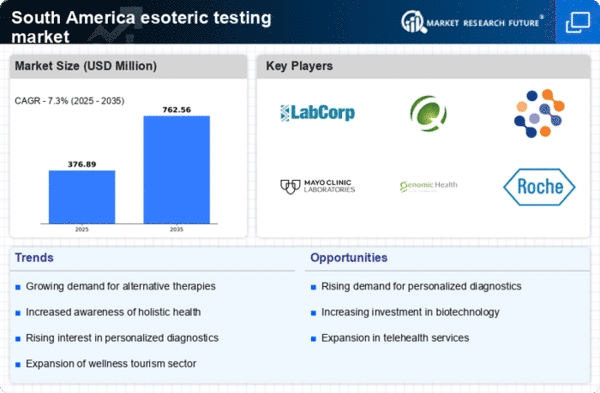

The esoteric testing market in South America is experiencing a notable surge in demand for personalized medicine. This trend is driven by a growing awareness among patients and healthcare providers regarding the benefits of tailored treatment plans. Personalized medicine relies heavily on advanced diagnostic techniques, including esoteric testing, to identify specific biomarkers and genetic profiles. As a result, the market is projected to grow at a CAGR of approximately 10% over the next five years. This growth is indicative of a broader shift towards individualized healthcare solutions, which are perceived to enhance treatment efficacy and patient outcomes. The esoteric testing market is thus positioned to play a pivotal role in the evolution of healthcare practices across the region.

Regulatory Support for Advanced Diagnostics

Regulatory bodies in South America are increasingly recognizing the importance of advanced diagnostics, including esoteric testing, in improving healthcare outcomes. This regulatory support is manifesting in the form of streamlined approval processes for new tests and increased funding for research initiatives. Such measures are likely to enhance the accessibility of esoteric testing services, thereby expanding the market. The esoteric testing market is expected to benefit from these favorable regulatory changes, which may lead to a projected market growth of around 12% over the next five years. This supportive environment encourages innovation and investment in the development of new testing methodologies, ultimately contributing to improved patient care and outcomes.

Rising Investment in Healthcare Infrastructure

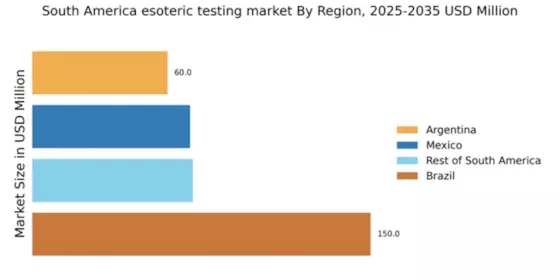

Investment in healthcare infrastructure across South America is a critical driver for the esoteric testing market. Governments and private entities are increasingly allocating resources to enhance laboratory facilities and expand testing capabilities. This investment is essential for meeting the growing demand for advanced diagnostic services, particularly in underserved regions. The esoteric testing market is poised to benefit from these infrastructural improvements, which are expected to facilitate the establishment of more testing centers and increase the availability of esoteric tests. Projections indicate that the market could experience a growth rate of approximately 8% as a result of these investments, reflecting a commitment to improving healthcare access and quality across the region.