Rising Dental Awareness

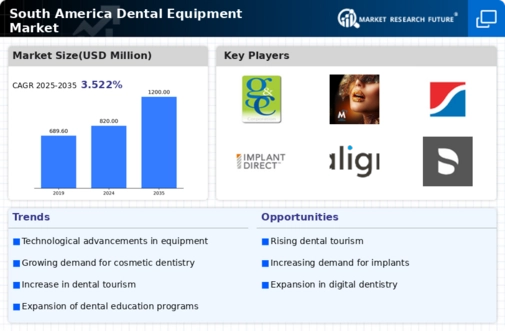

The increasing awareness regarding oral health in South America is driving the dental equipment market. Educational campaigns and initiatives by health organizations have led to a greater understanding of the importance of dental hygiene. As a result, more individuals are seeking regular dental check-ups and treatments, which in turn boosts the demand for advanced dental equipment. The market is projected to grow at a CAGR of approximately 7.5% over the next five years, indicating a robust expansion. This heightened awareness is particularly evident in urban areas, where access to dental care is improving. Consequently, dental practitioners are investing in modern equipment to meet the rising expectations of patients, thereby enhancing the overall quality of care in the dental equipment market.

Aging Population and Dental Needs

The aging population in South America is contributing to the growth of the dental equipment market. As the demographic shifts towards an older population, there is a corresponding increase in dental health issues such as periodontal disease and tooth loss. This demographic trend necessitates the use of specialized dental equipment to address the unique needs of older patients. The market is expected to expand by approximately 5% annually, driven by the demand for restorative and preventive dental care. Dental practitioners are increasingly focusing on geriatric dentistry, which requires specific equipment tailored to older patients. Thus, the dental equipment market is likely to see a rise in the development and adoption of equipment that caters to this demographic, ensuring that the dental needs of the aging population are adequately met.

Growing Cosmetic Dentistry Sector

The burgeoning cosmetic dentistry sector in South America is a key driver of the dental equipment market. As more individuals prioritize aesthetics, the demand for cosmetic procedures such as teeth whitening, veneers, and orthodontics is on the rise. This trend is reflected in the increasing sales of specialized dental equipment designed for cosmetic applications. The market for cosmetic dental equipment is projected to grow at a rate of 7% annually, indicating a strong consumer interest in aesthetic enhancements. Consequently, dental practitioners are investing in advanced equipment to cater to this growing clientele, thereby propelling the dental equipment market forward. This shift towards cosmetic dentistry not only enhances the profitability of dental practices but also encourages innovation in equipment design and functionality.

Government Initiatives and Funding

Government initiatives aimed at improving healthcare infrastructure in South America are significantly impacting the dental equipment market. Various countries in the region are allocating funds to enhance dental services, particularly in underserved areas. For instance, initiatives to provide subsidized dental care have led to increased procurement of dental equipment by public health facilities. This trend is expected to result in a market growth of around 6% annually. Furthermore, partnerships between governments and private sectors are fostering innovation and accessibility in dental care. As a result, the dental equipment market is likely to witness a surge in demand for both basic and advanced dental technologies, ensuring that a broader population has access to essential dental services.

Technological Integration in Dental Practices

The integration of advanced technologies in dental practices is reshaping the dental equipment market in South America. Innovations such as digital imaging, CAD/CAM systems, and laser dentistry are becoming increasingly prevalent. These technologies not only enhance the precision and efficiency of dental procedures but also improve patient experiences. The market for digital dental equipment is expected to grow by approximately 8% over the next few years, driven by the demand for more efficient and less invasive treatment options. As dental practitioners adopt these technologies, the dental equipment market is likely to expand, with a focus on high-quality, reliable equipment that meets the evolving needs of both practitioners and patients.