Rising Dental Care Awareness

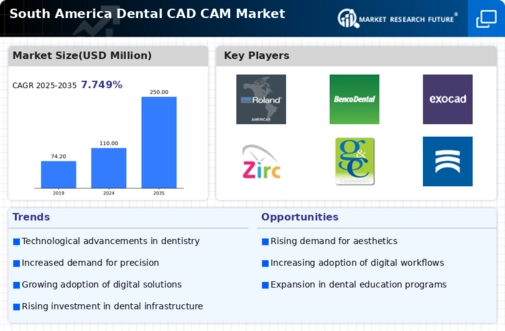

The increasing awareness regarding dental health in South America is a pivotal driver for the dental cad-cam market. As populations become more informed about the importance of oral hygiene and regular dental check-ups, the demand for advanced dental solutions rises. This trend is reflected in the growing number of dental clinics and practices adopting cad-cam technology to enhance service delivery. Reports indicate that the dental care market in South America is projected to grow at a CAGR of approximately 8% over the next five years, indicating a robust demand for innovative solutions. Consequently, the dental cad-cam market is likely to benefit from this heightened focus on preventive care and aesthetic improvements, as patients increasingly seek high-quality, efficient dental treatments.

Growing Middle-Class Population

The expansion of the middle-class population in South America is a crucial driver for the dental cad-cam market. As disposable incomes rise, more individuals are able to afford dental care services, including cosmetic procedures that utilize cad-cam technology. This demographic shift is leading to an increased demand for high-quality dental restorations, such as crowns and bridges, which can be efficiently produced using cad-cam systems. Market analysis suggests that the middle-class segment is expected to grow by approximately 15% in the coming years, further fueling the demand for advanced dental solutions. Consequently, the dental cad-cam market is likely to experience significant growth as more consumers seek out innovative and aesthetically pleasing dental treatments.

Increased Focus on Aesthetic Dentistry

The rising emphasis on aesthetic dentistry in South America is significantly influencing the dental cad-cam market. Patients are increasingly seeking dental solutions that not only restore function but also enhance appearance. This trend is driving the demand for cad-cam technology, which allows for the creation of highly customized and visually appealing dental restorations. As aesthetic considerations become a priority for many patients, dental practices are adopting cad-cam systems to meet these expectations. Market forecasts indicate that the aesthetic dentistry segment is likely to grow at a rate of 12% annually, underscoring the potential for the dental cad-cam market to thrive in this evolving landscape.

Regulatory Support for Dental Innovations

Regulatory frameworks in South America are increasingly supportive of innovations in the dental sector, which serves as a key driver for the dental cad-cam market. Governments are recognizing the importance of modernizing dental practices to improve patient care and outcomes. Initiatives aimed at promoting technological advancements and ensuring quality standards are encouraging dental professionals to adopt cad-cam systems. This regulatory support is expected to facilitate market growth, as practitioners are more likely to invest in advanced technologies that align with government guidelines. The dental cad-cam market is poised to benefit from these favorable conditions, potentially leading to a market expansion of around 9% over the next few years.

Technological Integration in Dental Practices

The integration of advanced technologies in dental practices is transforming the landscape of the dental cad-cam market in South America. Innovations such as 3D printing, digital imaging, and computer-aided design are becoming commonplace, allowing for more precise and efficient dental restorations. This technological shift not only enhances the quality of care but also reduces the time required for procedures, appealing to both practitioners and patients. As a result, dental practices are increasingly investing in cad-cam systems, which are expected to account for a significant share of the market. The dental cad-cam market is projected to see a growth rate of around 10% annually, driven by these technological advancements that streamline workflows and improve patient outcomes.