Rising Cyber Threats

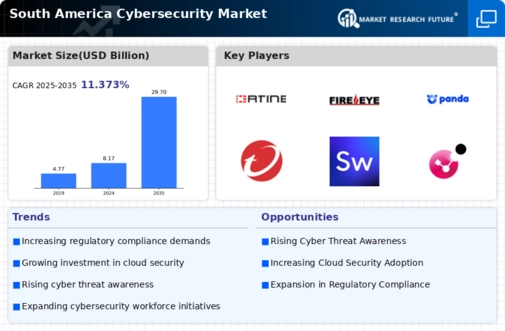

The South America Cyber Security Market is experiencing a surge in demand due to the increasing frequency and sophistication of cyber threats. Cybercriminals are targeting various sectors, including finance, healthcare, and government, leading to significant data breaches and financial losses. In 2025, it was reported that cyberattacks in South America resulted in losses exceeding 10 billion USD, highlighting the urgent need for robust cyber security measures. Organizations are compelled to invest in advanced security solutions to protect sensitive information and maintain customer trust. This trend is likely to continue as the digital landscape evolves, making the South America Cyber Security Market a critical area for investment and development.

Government Initiatives and Policies

The South America Cyber Security Market is bolstered by proactive government initiatives aimed at enhancing national cyber security frameworks. Countries such as Brazil and Argentina have implemented comprehensive cyber security strategies, focusing on public-private partnerships and international cooperation. For instance, Brazil's Cyber Defense Strategy emphasizes the importance of securing critical infrastructure and promoting cyber resilience. These government efforts are likely to create a conducive environment for the growth of the cyber security sector, as they encourage businesses to adopt necessary security measures. As regulatory frameworks strengthen, the South America Cyber Security Market is expected to expand, attracting both local and international investments.

Emergence of Cyber Security Startups

The South America Cyber Security Market is witnessing a proliferation of startups focused on innovative security solutions. These emerging companies are leveraging advanced technologies such as artificial intelligence and machine learning to address unique regional challenges. In 2025, it was reported that investment in cyber security startups in South America reached 500 million USD, indicating a vibrant ecosystem for innovation. This influx of new players is likely to enhance competition and drive technological advancements within the market. As startups continue to develop tailored solutions for local businesses, the South America Cyber Security Market is poised for significant growth, fostering a dynamic landscape for cyber security.

Digital Transformation and Cloud Adoption

The ongoing digital transformation across South America is a significant driver for the Cyber Security Market. As businesses increasingly migrate to cloud-based solutions, the demand for effective cyber security measures intensifies. In 2025, it was estimated that over 60% of South American enterprises had adopted cloud services, creating new vulnerabilities that cybercriminals may exploit. Consequently, organizations are prioritizing the implementation of security protocols to safeguard their cloud environments. This shift not only enhances operational efficiency but also necessitates a robust cyber security framework, thereby propelling the growth of the South America Cyber Security Market. The interplay between digital transformation and security needs is likely to shape future investments in this sector.

Increased Awareness of Cyber Security Risks

There is a growing awareness among businesses and consumers regarding the risks associated with cyber threats in the South America Cyber Security Market. Educational campaigns and high-profile cyber incidents have heightened the understanding of potential vulnerabilities. As a result, organizations are more inclined to invest in cyber security solutions to mitigate risks. In 2025, surveys indicated that approximately 75% of South American companies recognized cyber security as a top priority, reflecting a cultural shift towards proactive security measures. This heightened awareness is expected to drive demand for innovative security technologies and services, further contributing to the expansion of the South America Cyber Security Market.