Emergence of IoT Applications

The emergence of Internet of Things (IoT) applications is reshaping the communication test-measurement market in South America. As more devices become interconnected, the demand for reliable testing solutions to ensure seamless communication between these devices is growing. In 2025, it is estimated that the number of IoT devices in the region will surpass 1 billion, creating a substantial market for testing and measurement solutions. Companies are likely to adapt their offerings to cater to this expanding market, focusing on interoperability and performance testing to meet the unique challenges posed by IoT deployments.

Rising Cybersecurity Concerns

As cybersecurity threats continue to escalate, the communication test-measurement market is experiencing heightened demand for solutions that ensure secure communications. In South America, cyberattacks have increased by approximately 30% in recent years, prompting organizations to prioritize the integrity of their networks. This trend drives the need for advanced testing tools that can assess vulnerabilities and ensure compliance with security protocols. Consequently, companies in the communication test-measurement market are likely to develop specialized products aimed at enhancing network security, thereby addressing the growing concerns of businesses and consumers alike.

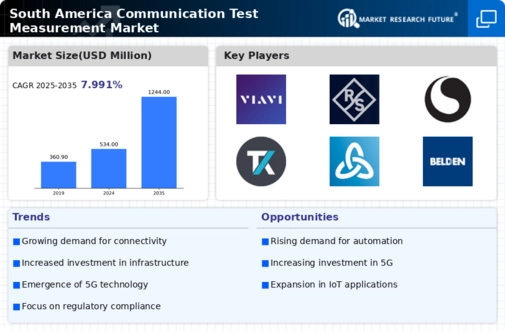

Growing Demand for High-Speed Connectivity

The increasing demand for high-speed connectivity in South America is a primary driver for the communication test-measurement market. As businesses and consumers alike seek faster internet speeds, the need for reliable testing and measurement solutions becomes paramount. In 2025, it is estimated that the number of broadband subscriptions in the region will reach approximately 80 million, reflecting a growth rate of around 10% annually. This surge necessitates advanced testing equipment to ensure network performance and reliability. Consequently, companies in the communication test-measurement market are likely to innovate and expand their product offerings to meet these demands, thereby enhancing their market presence.

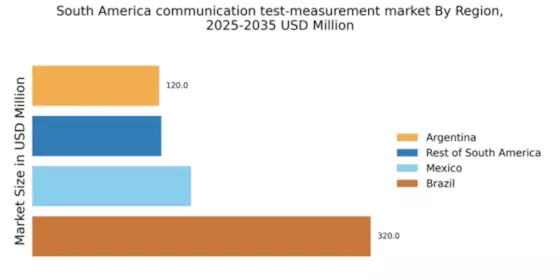

Expansion of Telecommunications Infrastructure

The ongoing expansion of telecommunications infrastructure across South America significantly influences the communication test-measurement market. Governments and private entities are investing heavily in upgrading existing networks and deploying new technologies, such as 5G. For instance, Brazil has allocated over $1 billion for the development of its telecommunications infrastructure in 2025. This investment is expected to create a robust demand for testing and measurement solutions to ensure that new installations meet quality standards. As a result, the communication test-measurement market is poised to benefit from this infrastructure growth, as companies seek to validate and optimize their network performance.

Increased Investment in Research and Development

Investment in research and development (R&D) within the communication test-measurement market is on the rise in South America. Companies are recognizing the importance of innovation to stay competitive in a rapidly evolving technological landscape. In 2025, it is projected that R&D spending in the telecommunications sector will increase by 15%, leading to the development of more sophisticated testing solutions. This focus on R&D not only enhances product offerings but also fosters collaboration between industry players and academic institutions, ultimately driving growth in the communication test-measurement market.