Emergence of IoT Applications

The rapid emergence of Internet of Things (IoT) applications across various sectors in Europe is significantly impacting the communication test-measurement market. As more devices become interconnected, the complexity of communication networks increases, necessitating advanced testing solutions to ensure seamless connectivity and performance. The IoT market in Europe is projected to reach €1 trillion by 2030, creating substantial opportunities for test-measurement providers. This growth compels the industry to develop innovative testing methodologies that can accommodate the unique challenges posed by IoT devices, such as scalability and interoperability. Consequently, the communication test-measurement market must evolve to support the burgeoning IoT landscape, ensuring reliable and efficient communication.

Increased Focus on Cybersecurity

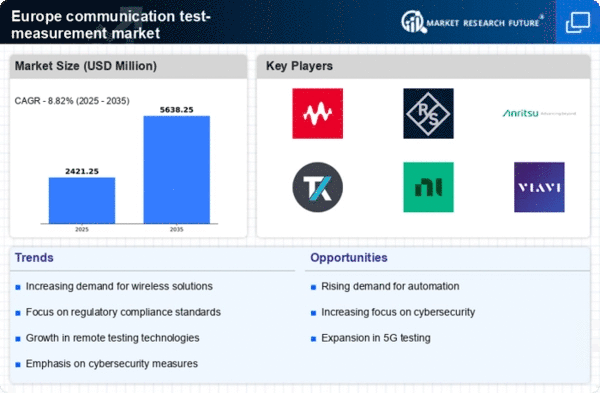

As cybersecurity threats continue to evolve, the communication test-measurement market in Europe is witnessing a heightened focus on security testing. Organizations are increasingly prioritizing the integrity and security of their communication systems, leading to a surge in demand for testing solutions that can identify vulnerabilities. The European Union has implemented various regulations aimed at enhancing cybersecurity, which further drives the need for comprehensive testing solutions. The market for cybersecurity testing tools is expected to grow by approximately 10% annually, reflecting the urgency for organizations to safeguard their communication networks. This trend underscores the importance of integrating security features into test-measurement equipment to meet regulatory requirements and protect sensitive data.

Regulatory Standards and Compliance

The stringent regulatory standards imposed by European authorities are a critical driver for the communication test-measurement market. Compliance with these regulations is essential for companies operating within the telecommunications sector, as non-compliance can result in significant penalties. The European Telecommunications Standards Institute (ETSI) has established various guidelines that necessitate rigorous testing of communication equipment. As a result, the demand for test-measurement solutions that can ensure compliance with these standards is on the rise. The market for compliance testing tools is expected to grow by approximately 8% annually, reflecting the increasing emphasis on regulatory adherence. This trend highlights the importance of developing testing solutions that not only meet current standards but are also adaptable to future regulatory changes.

Advancements in Telecommunications Infrastructure

The ongoing advancements in telecommunications infrastructure across Europe are driving the communication test-measurement market. As countries invest in upgrading their networks to support 5G technology, the demand for sophisticated testing equipment increases. The European telecommunications sector is projected to grow at a CAGR of approximately 7.5% from 2025 to 2030, necessitating enhanced testing capabilities. This growth is fueled by the need for reliable and high-speed communication services, which in turn propels the demand for effective test-measurement solutions. The communication test-measurement market must adapt to these advancements by providing tools that can handle the complexities of next-generation networks, ensuring optimal performance and compliance with stringent standards.

Growing Demand for High-Quality Communication Services

The growing demand for high-quality communication services among consumers and businesses in Europe is a significant driver for the communication test-measurement market. As users expect faster and more reliable communication, service providers are compelled to invest in advanced testing solutions to ensure optimal network performance. The market for communication services is projected to grow at a CAGR of around 6% through 2030, indicating a robust demand for effective test-measurement tools. This trend necessitates the development of innovative testing methodologies that can accurately assess network quality and performance. Consequently, the communication test-measurement market must focus on delivering solutions that enhance service quality and meet the evolving expectations of users.