Rising Health Insurance Coverage

The expansion of health insurance coverage in South America is contributing to the growth of the cardiac biomarkers market. As more individuals gain access to health insurance, the affordability of diagnostic tests, including cardiac biomarkers, improves significantly. This increased accessibility encourages more patients to seek preventive care and diagnostic testing, leading to higher demand for cardiac biomarkers. The cardiac biomarkers market is likely to see a positive impact from this trend, as healthcare providers are better positioned to offer comprehensive testing services. With an estimated 60% of the population expected to have health insurance by 2026, the market is poised for substantial growth.

Investment in Healthcare Infrastructure

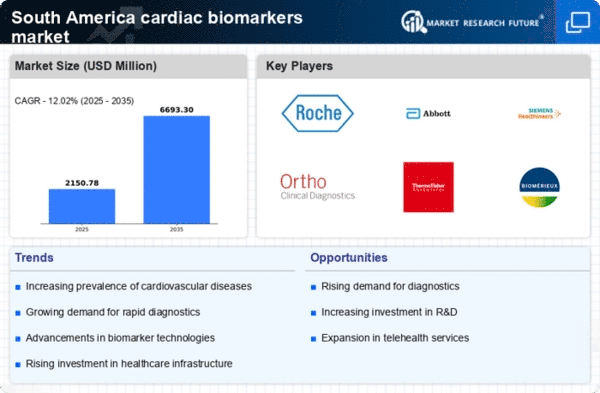

South America is witnessing a surge in investment aimed at enhancing healthcare infrastructure, which is likely to bolster the cardiac biomarkers market. Governments and private entities are channeling funds into modernizing healthcare facilities and expanding access to diagnostic services. This investment is crucial, as it enables the integration of advanced technologies, including cardiac biomarker testing, into routine clinical practice. The cardiac biomarkers market stands to benefit from improved laboratory capabilities and increased availability of testing services, which could lead to a higher adoption rate of these biomarkers in patient care. As a result, the market may see a compound annual growth rate (CAGR) of around 8% over the next few years.

Growing Demand for Personalized Medicine

The shift towards personalized medicine in South America is influencing the cardiac biomarkers market positively. Healthcare professionals are increasingly recognizing the value of tailoring treatment plans based on individual patient profiles, which often involves the use of specific cardiac biomarkers. This trend is supported by advancements in genomics and proteomics, allowing for more precise diagnostics and targeted therapies. The cardiac biomarkers market is likely to expand as healthcare providers adopt these personalized approaches, leading to improved patient outcomes and more efficient use of healthcare resources. The market could potentially reach a valuation of $1 billion by 2027, driven by this growing demand.

Rising Incidence of Cardiovascular Diseases

The increasing prevalence of cardiovascular diseases in South America is a primary driver for the cardiac biomarkers market. According to health statistics, cardiovascular diseases account for approximately 30% of all deaths in the region. This alarming trend necessitates the development and utilization of advanced diagnostic tools, including cardiac biomarkers, to facilitate early detection and management of these conditions. As healthcare providers and patients alike recognize the importance of timely diagnosis, the demand for cardiac biomarkers is expected to rise significantly. The cardiac biomarkers market is likely to experience substantial growth as healthcare systems invest in innovative solutions to combat the rising burden of cardiovascular diseases.

Increased Research and Development Activities

The cardiac biomarkers market in South America is being propelled by heightened research and development activities. Academic institutions and private companies are increasingly focusing on the discovery of novel biomarkers that can enhance diagnostic accuracy and prognostic capabilities. This emphasis on R&D is crucial, as it fosters innovation and the introduction of new products into the market. Collaborations between research entities and healthcare providers are becoming more common, facilitating the translation of scientific discoveries into clinical applications. The cardiac biomarkers market is expected to benefit from these advancements, with new biomarker tests likely to emerge, further driving market growth and diversification.