Rising Demand for Transparency

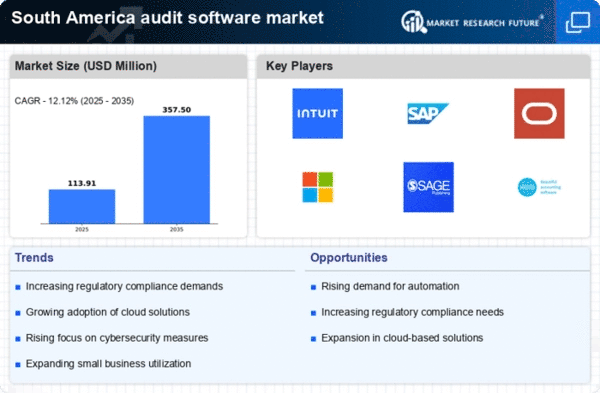

The audit software market in South America experiences a notable surge in demand for transparency across various sectors. Organizations are increasingly required to provide clear and accessible financial information to stakeholders, including investors and regulatory bodies. This trend is driven by heightened scrutiny from both local and international regulatory agencies, which emphasizes the need for robust auditing practices. As a result, companies are investing in advanced audit software solutions to enhance their reporting capabilities. The market is projected to grow at a CAGR of approximately 12% over the next five years, reflecting the increasing importance of transparency in financial operations. This driver indicates a shift towards more accountable business practices, thereby fostering trust among stakeholders and potentially leading to improved financial performance in the audit software market.

Increased Focus on Cybersecurity

The growing emphasis on cybersecurity is emerging as a critical driver for the audit software market in South America. As businesses face escalating threats from cyberattacks, there is a pressing need for audit solutions that can assess and mitigate these risks effectively. Organizations are investing in software that not only facilitates traditional auditing but also incorporates cybersecurity assessments into their frameworks. This trend is likely to enhance the overall security posture of companies, ensuring compliance with regulatory requirements related to data protection. The audit software market is expected to benefit from this focus, as firms prioritize solutions that provide comprehensive security features alongside standard auditing functionalities.

Shift Towards Remote Auditing Practices

The shift towards remote auditing practices is reshaping the audit software market in South America. As organizations adapt to changing work environments, there is an increasing need for software that supports remote auditing capabilities. This trend is driven by the necessity for flexibility and efficiency in audit processes, allowing auditors to conduct assessments from various locations. Companies are seeking solutions that facilitate collaboration and communication among audit teams, regardless of geographical constraints. The audit software market is likely to see a rise in demand for platforms that offer cloud-based functionalities, enabling seamless access to audit data and documentation. This shift may lead to enhanced productivity and reduced operational costs for organizations.

Technological Advancements in Data Analytics

Technological advancements in data analytics are significantly influencing the audit software market in South America. The integration of sophisticated data analysis tools allows auditors to process vast amounts of information efficiently, thereby enhancing the accuracy and speed of audits. Companies are increasingly adopting software that incorporates artificial intelligence and machine learning capabilities, which can identify anomalies and trends that may not be apparent through traditional methods. This shift is expected to drive market growth, as organizations seek to leverage technology to improve their auditing processes. The audit software market is likely to see a rise in demand for solutions that offer real-time data analysis, which can lead to more informed decision-making and risk management strategies.

Growing Importance of Environmental, Social, and Governance (ESG) Factors

The growing importance of Environmental, Social, and Governance (ESG) factors is becoming a pivotal driver for the audit software market in South America. Companies are increasingly recognizing the need to incorporate ESG considerations into their auditing processes, as stakeholders demand greater accountability regarding sustainability and ethical practices. This trend is prompting organizations to seek audit software that can effectively evaluate and report on ESG metrics. The audit software market is likely to experience growth as firms invest in solutions that align with these emerging standards, thereby enhancing their reputational capital and compliance with evolving regulations. This focus on ESG factors may also lead to improved risk management and long-term strategic planning.