Growth in Oil and Gas Sector

The oil and gas sector in South America is experiencing a resurgence, which is positively impacting the air operated-double-diaphragm-pumps market. These pumps are essential for transferring various fluids, including crude oil and chemicals, in exploration and production activities. The sector's growth is anticipated to contribute to a market expansion of approximately 7% over the next five years. As companies invest in infrastructure and technology to enhance extraction and processing efficiency, the demand for reliable pumping solutions will likely increase. This trend indicates a robust relationship between the oil and gas industry's performance and the air operated-double-diaphragm-pumps market, suggesting that as exploration activities intensify, so too will the need for these pumps.

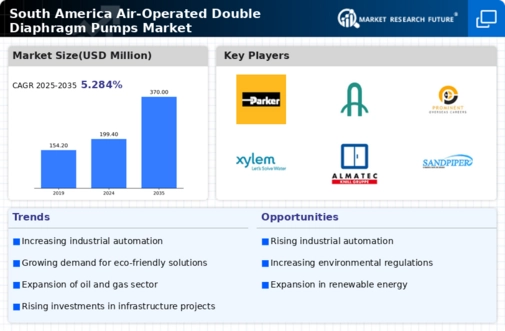

Increasing Industrialization

The ongoing industrialization in South America is a pivotal driver for the air operated-double-diaphragm-pumps market. As industries expand, the demand for efficient fluid transfer solutions rises. Sectors such as chemicals, food and beverage, and pharmaceuticals are increasingly adopting these pumps due to their reliability and versatility. The market is projected to grow at a CAGR of approximately 6% from 2025 to 2030, reflecting the increasing need for robust pumping solutions in various industrial applications. Furthermore, the push for modernization in manufacturing processes necessitates the integration of advanced pumping technologies, thereby enhancing the market's growth potential. This trend indicates a strong correlation between industrial growth and the demand for air operated-double-diaphragm-pumps, suggesting that as industries evolve, so too will the need for these essential components.

Technological Innovations in Pump Design

Technological innovations in pump design are driving advancements in the air operated-double-diaphragm-pumps market. Manufacturers are increasingly focusing on enhancing pump efficiency, durability, and ease of maintenance. Innovations such as improved materials and smart technology integration are making these pumps more reliable and user-friendly. The market is expected to grow at a rate of around 5% as these advancements attract new customers seeking high-performance solutions. This trend suggests that as technology continues to evolve, the air operated-double-diaphragm-pumps market will likely see increased competition and a broader range of offerings, catering to diverse industrial needs. The emphasis on innovation indicates a dynamic market landscape, where continuous improvement is essential for maintaining competitiveness.

Regulatory Compliance and Safety Standards

In South America, stringent regulatory compliance and safety standards are significantly influencing the air operated-double-diaphragm-pumps market. Industries are mandated to adhere to environmental and safety regulations, which necessitate the use of reliable and safe pumping solutions. Air operated-double-diaphragm-pumps are favored for their ability to handle hazardous materials without leakage, thus ensuring compliance with safety protocols. The market is expected to witness a growth rate of around 5% annually as companies prioritize safety and environmental responsibility. This trend underscores the importance of regulatory frameworks in shaping market dynamics, as businesses increasingly seek solutions that not only meet operational needs but also align with legal requirements. Consequently, the emphasis on compliance is likely to drive the adoption of air operated-double-diaphragm-pumps across various sectors.

Rising Demand for Water Treatment Solutions

The increasing focus on water treatment in South America is a significant driver for the air operated-double-diaphragm-pumps market. With growing concerns over water quality and availability, industries are investing in advanced water treatment technologies. Air operated-double-diaphragm-pumps are particularly suited for this application due to their ability to handle corrosive and abrasive fluids. The market is projected to grow by approximately 6% as municipalities and industries seek efficient solutions for water purification and wastewater management. This trend highlights the critical role of effective pumping systems in addressing water-related challenges, indicating that the air operated-double-diaphragm-pumps market will likely benefit from the heightened emphasis on sustainable water management practices.