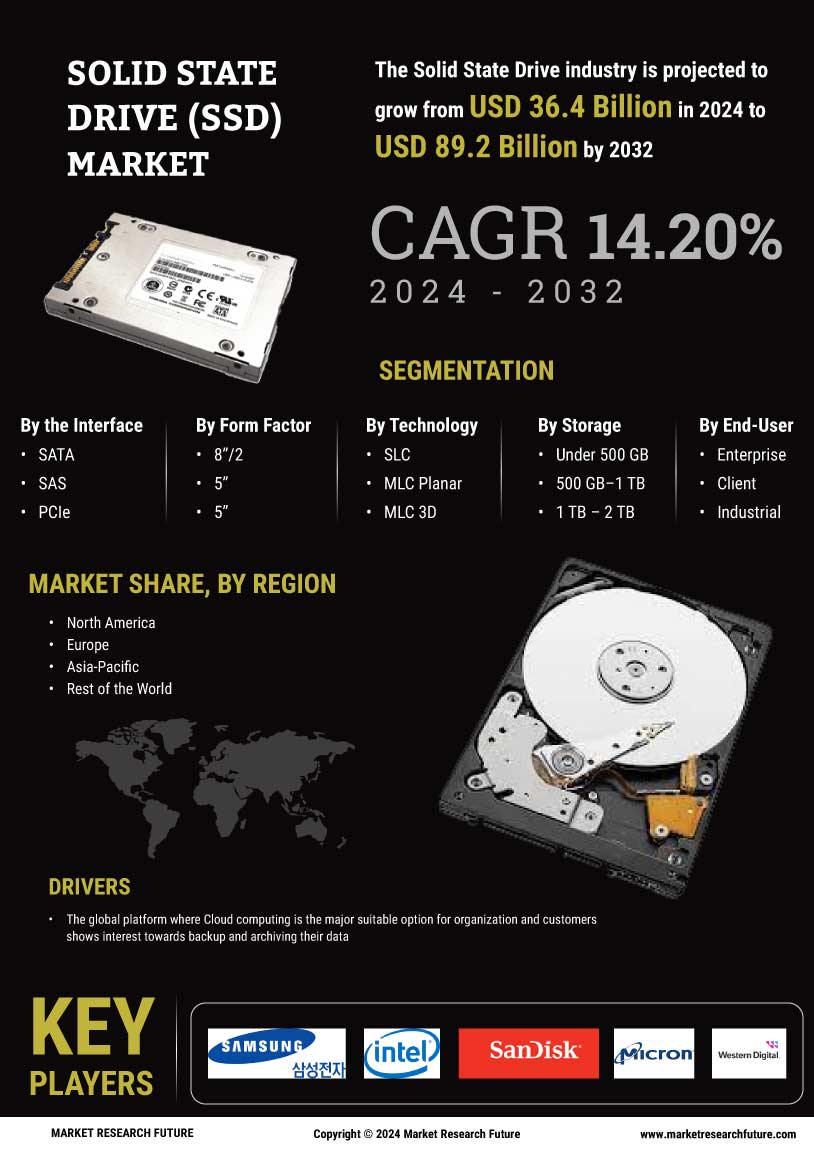

Rising Demand for Data Security

In an era where data breaches and cyber threats are prevalent, the Solid State Drive (SSD) Market is witnessing a heightened demand for data security features. Organizations are increasingly prioritizing secure storage solutions to protect sensitive information. SSDs equipped with hardware encryption and secure erase capabilities are becoming essential for businesses that handle confidential data. According to recent statistics, the market for encrypted SSDs is projected to grow at a compound annual growth rate of over 20% in the coming years. This trend indicates a shift towards prioritizing data integrity and security in storage solutions. As more companies adopt stringent data protection regulations, the demand for secure SSDs is expected to rise, further driving growth in the Solid State Drive (SSD) Market.

Shift Towards Consumer Electronics

The Solid State Drive (SSD) Market is experiencing a notable shift towards consumer electronics, driven by the increasing adoption of SSDs in laptops, desktops, and gaming consoles. As consumers seek faster boot times and improved overall system performance, manufacturers are integrating SSDs into their products more frequently. Recent data suggests that SSDs now account for over 50% of the storage market in consumer laptops, reflecting a significant transition from traditional hard disk drives (HDDs). This trend is further fueled by the rise of ultrabooks and compact devices that prioritize speed and efficiency. As consumer preferences evolve towards high-performance electronics, the Solid State Drive (SSD) Market is poised for continued growth, with manufacturers focusing on developing cost-effective SSD solutions to meet this demand.

Technological Advancements in SSDs

The Solid State Drive (SSD) Market is experiencing rapid technological advancements that enhance performance and efficiency. Innovations such as 3D NAND technology and NVMe interfaces are driving the development of faster and more reliable storage solutions. For instance, the introduction of PCIe 4.0 has significantly increased data transfer rates, allowing SSDs to achieve speeds exceeding 7000 MB/s. This surge in performance is appealing to consumers and enterprises alike, as it supports demanding applications such as video editing, gaming, and data analytics. Furthermore, advancements in controller technology and firmware optimization are improving endurance and reliability, which are critical factors for users. As these technologies continue to evolve, they are likely to reshape the landscape of the Solid State Drive (SSD) Market, making SSDs more accessible and appealing to a broader audience.

Emergence of Cloud Storage Solutions

The emergence of cloud storage solutions is reshaping the Solid State Drive (SSD) Market, as businesses and individuals increasingly rely on cloud services for data storage and management. The integration of SSDs in cloud infrastructure enhances performance, enabling faster data access and improved reliability. As organizations migrate to cloud-based platforms, the demand for SSDs in data centers is expected to rise significantly. Recent projections indicate that the cloud storage market is set to grow at a compound annual growth rate of around 25%, which will likely drive the need for high-performance SSDs. This trend suggests that the Solid State Drive (SSD) Market will continue to evolve, with a focus on providing scalable and efficient storage solutions that cater to the needs of cloud service providers.

Growth in Gaming and High-Performance Computing

The Solid State Drive (SSD) Market is significantly influenced by the growth in gaming and high-performance computing (HPC) sectors. Gamers and professionals in fields such as data science and artificial intelligence require high-speed storage solutions to enhance their experience and productivity. The increasing popularity of online gaming and the demand for immersive experiences are propelling the need for SSDs that offer low latency and high read/write speeds. Recent market analyses indicate that the gaming SSD segment is expected to witness a growth rate of approximately 15% annually. This trend is further supported by the rise of cloud gaming services, which necessitate fast and reliable storage solutions. As the gaming and HPC markets continue to expand, the Solid State Drive (SSD) Market is likely to benefit from this growing demand.