Growth in Renewable Energy Sector

The AC Drives Market is poised for growth due to the increasing integration of renewable energy sources. As the world shifts towards sustainable energy solutions, the demand for AC drives in applications such as wind and solar energy is on the rise. These drives are essential for managing the variable output of renewable energy systems, ensuring efficient energy conversion and distribution. Recent reports suggest that the renewable energy sector is expected to expand significantly, with investments reaching trillions of dollars in the coming years. This expansion is likely to create new opportunities for the AC Drives Market, as more projects require sophisticated motor control solutions to optimize energy generation and consumption.

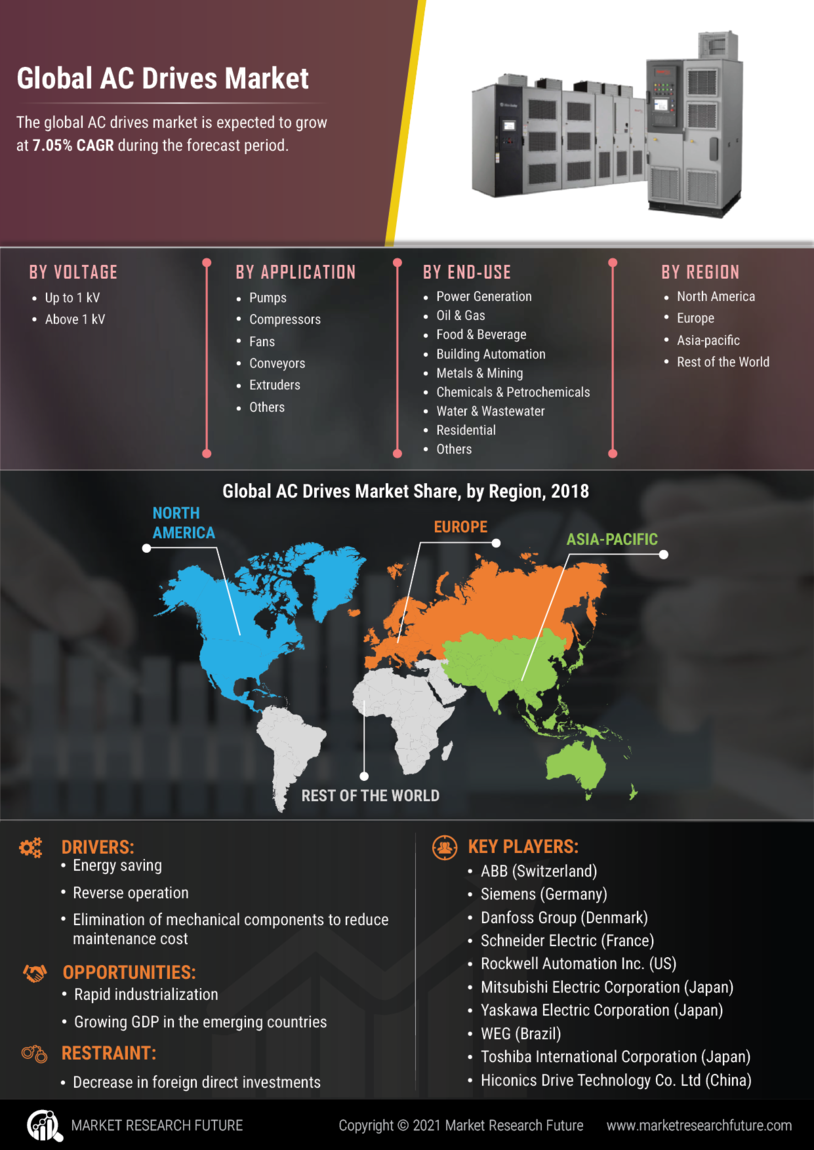

Rising Demand for Energy Efficiency

The AC Drives Market is experiencing a notable surge in demand for energy-efficient solutions. As industries strive to reduce operational costs and enhance sustainability, the adoption of AC drives has become increasingly prevalent. These drives facilitate precise control of motor speed and torque, leading to significant energy savings. According to recent data, the implementation of AC drives can result in energy savings of up to 50% in various applications. This trend is particularly evident in sectors such as manufacturing, HVAC, and water treatment, where energy consumption is substantial. Consequently, the growing emphasis on energy efficiency is likely to propel the AC Drives Market forward, as businesses seek to optimize their energy usage and comply with stringent regulations.

Expansion of Electric Vehicle Infrastructure

The AC Drives Market is benefiting from the rapid expansion of electric vehicle (EV) infrastructure. As the adoption of electric vehicles accelerates, the demand for efficient motor control solutions is increasing. AC drives are integral to the operation of electric vehicle charging stations, ensuring optimal performance and energy management. The AC Drives Market is projected to grow exponentially, with millions of EVs expected to be on the roads in the coming years. This growth is likely to create a substantial demand for AC drives, as they are essential for managing the power requirements of charging systems. The expansion of EV infrastructure is thus expected to significantly contribute to the growth of the AC Drives Market.

Industrial Automation and Smart Manufacturing

The AC Drives Market is significantly influenced by the ongoing trend of industrial automation and the rise of smart manufacturing. As industries increasingly adopt automation technologies, the need for advanced motor control solutions becomes paramount. AC drives play a crucial role in automating processes, enhancing productivity, and ensuring precision in operations. The integration of AC drives with IoT and AI technologies allows for real-time monitoring and control, further optimizing performance. Recent statistics indicate that the automation market is projected to grow at a compound annual growth rate of over 10%, which bodes well for the AC Drives Market. This growth is likely to be driven by the need for increased efficiency and reduced downtime in manufacturing processes.

Regulatory Compliance and Environmental Standards

The AC Drives Market is increasingly shaped by stringent regulatory compliance and environmental standards. Governments worldwide are implementing policies aimed at reducing carbon emissions and promoting energy efficiency. As a result, industries are compelled to adopt technologies that align with these regulations. AC drives are recognized for their ability to enhance energy efficiency and reduce emissions, making them a preferred choice for many organizations. Recent data indicates that compliance with environmental standards can lead to substantial cost savings and improved operational efficiency. Consequently, the push for regulatory compliance is likely to drive the growth of the AC Drives Market, as businesses seek to meet legal requirements while also enhancing their sustainability efforts.