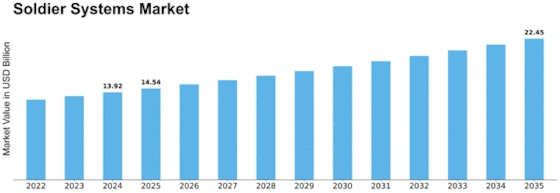

Soldier Systems Size

Soldier Systems Market Growth Projections and Opportunities

The Soldier Systems Market is a dynamic sector within the defense industry, focusing on the development and integration of advanced technologies to enhance the capabilities and effectiveness of individual soldiers on the battlefield. Several market factors contribute to the dynamics of this specialized industry, reflecting the continuous demand for innovative soldier-centric solutions. One primary factor shaping the market is the evolving nature of modern warfare and the need for soldiers to be equipped with cutting-edge technologies. As military operations become more complex and diversified, the demand for integrated soldier systems has increased, encompassing a range of equipment such as communication devices, body armor, personal protective gear, and advanced weaponry.

The Soldier Systems Market is valued at USD 18.20 billion, poised to grow at a CAGR of 6.01% from 2020 to 2030. Soldier systems refer to equipment that enhances the operational capabilities of soldiers during combat, and they are extensively procured by defense organizations worldwide.

Technological advancements play a pivotal role in influencing the Soldier Systems Market. The continuous development of lightweight materials, smart textiles, augmented reality displays, and integrated sensor technologies contributes to the evolution of soldier systems. These technological innovations not only enhance the survivability and situational awareness of individual soldiers but also improve their communication and connectivity on the battlefield. The integration of artificial intelligence, wearable devices, and advanced medical technologies further transforms soldier systems into intelligent and adaptive solutions, providing soldiers with a competitive edge in modern warfare.

The changing landscape of threats and operational environments significantly impacts the Soldier Systems Market. As armed forces adapt to unconventional and asymmetric challenges, there is a growing emphasis on providing soldiers with versatile and adaptable equipment. Soldier systems are designed to address a spectrum of threats, from traditional combat scenarios to counterinsurgency and peacekeeping missions. The market's responsiveness to the diverse needs of military operations contributes to the development of modular and interoperable soldier systems capable of meeting a range of mission requirements.

Geopolitical considerations play a significant role in shaping the Soldier Systems Market. Nations with strategic security concerns invest in the development and procurement of advanced soldier systems to ensure the readiness and effectiveness of their armed forces. The market is often influenced by the perceived threat landscape, regional conflicts, and the strategic imperatives of countries seeking to maintain a technological advantage in the capabilities of their soldiers.

Defense budgets and military spending are crucial factors in the Soldier Systems Market. Governments allocate funds for the acquisition and modernization of soldier systems as part of their overall defense strategy. Budgetary constraints may impact the scale and pace of soldier system deployments, but the strategic importance of equipping soldiers with state-of-the-art technologies ensures a sustained demand for advanced solutions. The balance between economic considerations and national security priorities plays a crucial role in determining the market's growth trajectory.

Research and development efforts within the military sector contribute to the market's evolution. Military organizations collaborate with industry partners to enhance soldier system technology, introducing features such as enhanced communication capabilities, integrated sensors for threat detection, and advancements in medical support systems. These innovations are driven by the continuous pursuit of optimizing soldier protection, performance, and effectiveness in diverse operational environments.

Environmental considerations, such as extreme weather conditions and terrain challenges, influence the Soldier Systems Market. Soldier systems are designed to withstand a range of environmental factors, ensuring the reliability and functionality of equipment in various climates and terrains. Manufacturers in the market invest in research and development to enhance the resilience of soldier systems, addressing challenges related to temperature extremes, moisture, and rugged landscapes.

Leave a Comment