Rising Energy Demand

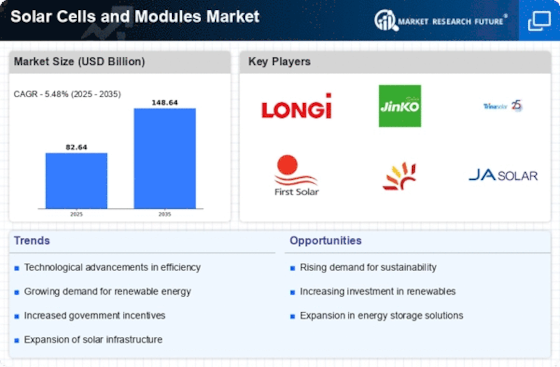

The increasing The Solar Cells and Modules Industry. As populations grow and economies expand, the need for sustainable energy solutions becomes more pressing. Solar energy presents a viable alternative to meet this demand, particularly in regions with abundant sunlight. According to recent estimates, the demand for electricity is projected to rise significantly in the coming years, prompting a shift towards renewable energy sources. The Solar Cells and Modules Market stands to gain from this trend, as more consumers and businesses seek to integrate solar solutions into their energy portfolios. This shift not only addresses energy needs but also aligns with broader environmental goals.

Technological Innovations

Technological innovations are transforming the Solar Cells and Modules Market, leading to enhanced efficiency and performance of solar panels. Recent advancements in materials science, such as the development of bifacial solar panels and perovskite solar cells, have the potential to increase energy conversion rates significantly. These innovations not only improve the overall efficiency of solar systems but also reduce the space required for installations. As technology continues to evolve, the Solar Cells and Modules Market is likely to see a surge in demand for high-performance solar solutions, appealing to both residential and commercial sectors. This trend may also stimulate further research and development, fostering a competitive landscape.

Cost Reduction in Solar Technology

The Solar Cells and Modules Market is experiencing a notable trend towards cost reduction in solar technology. Advances in manufacturing processes and economies of scale have led to a decrease in the price of solar panels. For instance, the average cost of solar photovoltaic (PV) modules has dropped significantly over the past few years, making solar energy more accessible to consumers and businesses alike. This reduction in costs is likely to drive increased adoption of solar technologies, as both residential and commercial sectors seek to capitalize on lower installation expenses. Furthermore, as the technology continues to evolve, the Solar Cells and Modules Market may witness further price declines, potentially enhancing its competitiveness against traditional energy sources.

Government Incentives and Subsidies

Government incentives and subsidies play a crucial role in shaping the Solar Cells and Modules Market. Various countries have implemented policies aimed at promoting renewable energy adoption, including tax credits, rebates, and grants for solar installations. These financial incentives can significantly reduce the upfront costs associated with solar energy systems, thereby encouraging more consumers to invest in solar technology. For example, in certain regions, homeowners can receive substantial tax benefits for installing solar panels, which can lead to a rapid return on investment. As governments continue to prioritize renewable energy in their agendas, the Solar Cells and Modules Market is likely to benefit from sustained support, fostering growth and innovation.

Environmental Concerns and Sustainability

Growing environmental concerns and the push for sustainability are pivotal drivers in the Solar Cells and Modules Market. As awareness of climate change and its impacts increases, consumers and businesses are increasingly seeking eco-friendly energy solutions. Solar energy, being a clean and renewable resource, aligns with these sustainability goals. The transition towards greener energy sources is not only a response to environmental challenges but also a strategic move for many organizations aiming to enhance their corporate social responsibility profiles. This shift is likely to bolster the Solar Cells and Modules Market, as more stakeholders recognize the long-term benefits of investing in solar technology for both economic and environmental reasons.