Government Investments in Infrastructure

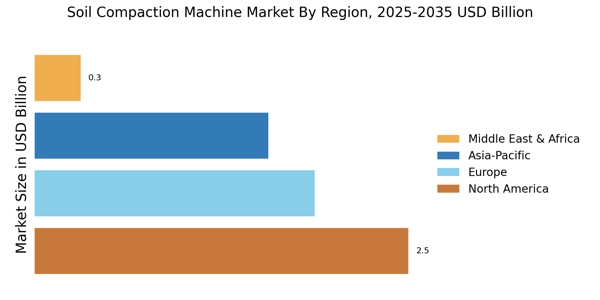

Government investments in infrastructure projects are a critical driver for the Soil Compaction Machine Market. Many governments are allocating substantial budgets towards the development and maintenance of public infrastructure, which includes roads, highways, and public facilities. This influx of funding is likely to stimulate demand for soil compaction machines, as these are essential for preparing sites for construction. Data indicates that infrastructure spending is expected to rise, particularly in emerging economies, where the need for improved transportation networks is paramount. As a result, manufacturers are poised to benefit from increased orders and contracts, further propelling market growth.

Sustainability Initiatives Driving Demand

In the Soil Compaction Machine Market, sustainability initiatives are increasingly influencing purchasing decisions. As environmental regulations become more stringent, construction companies are seeking machines that minimize carbon footprints and enhance energy efficiency. The demand for eco-friendly soil compaction machines, such as those powered by alternative fuels or featuring lower emissions, is on the rise. This shift is not only driven by regulatory compliance but also by a growing awareness of corporate social responsibility among industry players. Market data suggests that the segment of sustainable soil compaction machines is expected to account for a significant share of the overall market by 2026, reflecting a broader trend towards greener construction practices.

Rising Urbanization and Infrastructure Development

The Soil Compaction Machine Market is significantly influenced by the ongoing trend of rising urbanization and infrastructure development. As urban areas expand, the demand for robust infrastructure, including roads, bridges, and buildings, intensifies. This surge in construction activities necessitates efficient soil compaction to ensure the stability and longevity of structures. Recent statistics indicate that urbanization rates are projected to increase, particularly in developing regions, leading to a heightened need for soil compaction machines. Consequently, manufacturers are focusing on producing versatile machines that can cater to various soil types and compaction requirements, thereby driving market growth.

Technological Advancements in Soil Compaction Machines

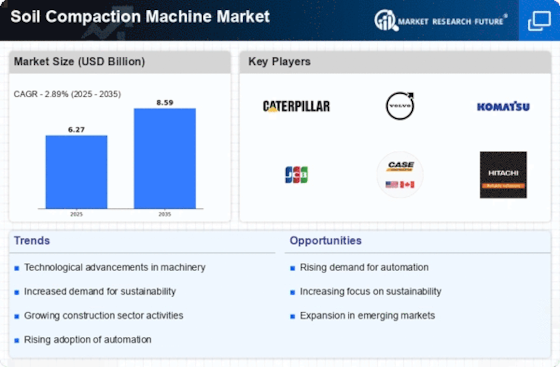

The Soil Compaction Machine Market is experiencing a notable transformation due to rapid technological advancements. Innovations such as automated compaction systems and telematics integration are enhancing operational efficiency and precision. These advancements allow for real-time monitoring of compaction levels, which is crucial for ensuring optimal soil density. Furthermore, the introduction of electric and hybrid models is addressing environmental concerns while maintaining performance standards. According to recent data, the market for advanced soil compaction machines is projected to grow at a compound annual growth rate of approximately 6% over the next five years. This growth is indicative of the industry's shift towards more sophisticated machinery that meets the demands of modern construction and infrastructure projects.

Growing Construction Industry and Demand for Compaction Equipment

The Soil Compaction Machine Market is witnessing growth driven by the expanding construction industry. As construction activities ramp up across various sectors, including residential, commercial, and industrial, the need for effective soil compaction becomes paramount. Compaction equipment is essential for ensuring the stability and durability of foundations, which is critical in construction. Market analysis reveals that the construction sector is projected to grow steadily, with an increasing number of projects requiring advanced compaction solutions. This trend is likely to result in heightened demand for soil compaction machines, as contractors seek reliable and efficient equipment to meet project timelines and quality standards.