Increased Awareness of Soil Health

There is a growing awareness among farmers and agricultural stakeholders regarding the critical role of soil health in achieving sustainable agricultural outcomes. The US Soil Conditioners Market is benefiting from this heightened awareness, as more farmers recognize the importance of maintaining soil structure, fertility, and microbial activity. Educational programs and workshops conducted by agricultural extension services are helping to disseminate knowledge about the benefits of soil conditioners. This increased understanding is likely to lead to higher adoption rates of soil conditioners, as farmers seek to enhance their soil's health and productivity. Consequently, the market for soil conditioners is expected to expand as more stakeholders prioritize soil health.

Shift Towards Organic Farming Practices

The US Soil Conditioners Market is witnessing a shift towards organic farming practices, which is driving the demand for organic soil conditioners. As consumers increasingly prefer organic produce, farmers are adapting their practices to meet this demand. Organic soil conditioners, which are derived from natural sources, are becoming essential for maintaining soil fertility and structure in organic farming systems. The market for organic soil conditioners is projected to grow significantly, as more farmers transition to organic methods. This trend is supported by various certification programs and consumer awareness campaigns that promote organic farming. As a result, the US Soil Conditioners Market is likely to see a substantial increase in the adoption of organic soil conditioners.

Rising Demand for Sustainable Agriculture

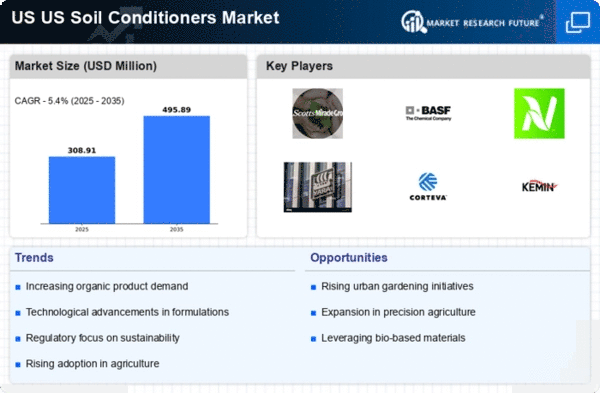

The US Soil Conditioners Market is experiencing a notable increase in demand driven by the growing emphasis on sustainable agricultural practices. Farmers are increasingly adopting soil conditioners to enhance soil health, improve crop yields, and reduce environmental impact. According to recent data, the market for soil conditioners is projected to grow at a compound annual growth rate of approximately 5.2% through 2026. This trend is largely influenced by consumer preferences for sustainably sourced food products, prompting farmers to invest in soil health. The US government has also introduced various initiatives to promote sustainable farming, further bolstering the market for soil conditioners. As a result, the integration of soil conditioners into farming practices is likely to become a standard approach in the quest for sustainable agriculture.

Government Policies Supporting Soil Health

The US Soil Conditioners Market is significantly influenced by government policies aimed at promoting soil health and sustainable farming practices. Various federal and state programs provide financial incentives for farmers to adopt soil conditioners as part of their agricultural practices. For instance, the USDA's Natural Resources Conservation Service offers cost-sharing programs that encourage the use of soil amendments to improve soil quality. These policies not only support farmers financially but also raise awareness about the importance of soil health in agricultural productivity. As these initiatives continue to evolve, they are expected to drive the demand for soil conditioners, positioning them as essential components in modern farming.

Technological Advancements in Soil Management

Technological innovations are playing a pivotal role in the US Soil Conditioners Market, as advancements in soil management technologies are enhancing the effectiveness of soil conditioners. Precision agriculture tools, such as soil sensors and data analytics, allow farmers to apply soil conditioners more efficiently, optimizing their usage and maximizing benefits. The integration of these technologies is expected to increase the adoption rate of soil conditioners, as farmers seek to improve soil quality and crop productivity. Furthermore, the development of bio-based soil conditioners, which are derived from natural materials, is gaining traction. This shift towards technology-driven solutions is likely to reshape the market landscape, making it more competitive and innovative.