Supportive Regulatory Frameworks

The Sodium Salt Battery Market is benefiting from supportive regulatory frameworks that promote clean energy technologies. Governments worldwide are implementing policies and incentives aimed at reducing carbon emissions and fostering the adoption of renewable energy sources. These regulations often include subsidies for energy storage solutions, tax incentives for manufacturers, and mandates for cleaner technologies. Such supportive measures are likely to create a favorable environment for the growth of sodium salt batteries, as they align with governmental objectives to transition towards sustainable energy systems. As regulatory support continues to strengthen, the Sodium Salt Battery Market is expected to gain momentum, attracting new players and investments.

Environmental Benefits and Sustainability

The Sodium Salt Battery Market is increasingly recognized for its environmental benefits and sustainability. Sodium salt batteries are considered more eco-friendly compared to traditional lithium-ion batteries, primarily due to the abundance of sodium and the reduced environmental impact associated with their production and disposal. The growing emphasis on sustainable energy solutions is prompting industries to seek alternatives that align with environmental regulations and consumer preferences. Market trends indicate a shift towards greener technologies, with sodium salt batteries positioned as a favorable option. This alignment with sustainability goals is likely to drive investment and innovation within the Sodium Salt Battery Market, as companies strive to meet the demands of environmentally conscious consumers.

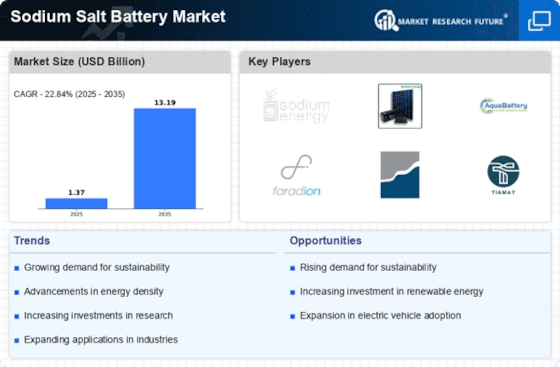

Rising Demand for Energy Storage Solutions

The Sodium Salt Battery Market is experiencing a notable surge in demand for energy storage solutions, driven by the increasing need for reliable and efficient energy systems. As renewable energy sources, such as solar and wind, become more prevalent, the necessity for effective energy storage technologies intensifies. Sodium salt batteries, with their potential for high energy density and cost-effectiveness, are emerging as a viable alternative to traditional lithium-ion batteries. Market data indicates that the energy storage sector is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 20% in the coming years. This growth is likely to propel the Sodium Salt Battery Market forward, as stakeholders seek sustainable and scalable energy storage options.

Cost-Effectiveness of Sodium Salt Batteries

One of the compelling drivers for the Sodium Salt Battery Market is the cost-effectiveness associated with sodium salt batteries. Compared to lithium-ion batteries, sodium salt batteries utilize more abundant and less expensive raw materials, which can lead to lower production costs. This economic advantage is particularly appealing for large-scale applications, such as grid storage and electric vehicles, where cost efficiency is paramount. Recent analyses suggest that the total cost of ownership for sodium salt batteries could be significantly lower than that of their lithium counterparts, making them an attractive option for manufacturers and consumers alike. As the market continues to evolve, the affordability of sodium salt batteries is likely to enhance their adoption across various sectors.

Technological Innovations in Battery Design

Technological advancements play a crucial role in shaping the Sodium Salt Battery Market. Innovations in battery design and materials are enhancing the performance and efficiency of sodium salt batteries, making them more competitive with established technologies. Research and development efforts are focused on improving energy density, cycle life, and charging rates, which are essential for meeting the demands of modern applications. Recent studies indicate that breakthroughs in electrode materials and electrolyte formulations could lead to significant improvements in battery performance. As these innovations materialize, they are expected to attract further investment and interest in the Sodium Salt Battery Market, potentially accelerating its growth trajectory.