Rising Health Awareness

The increasing awareness regarding the adverse health effects of nicotine consumption appears to be a primary driver for the Nicotine De-addiction Product Market. As more individuals recognize the risks associated with smoking and nicotine use, there is a growing demand for effective cessation products. Reports indicate that approximately 70% of smokers express a desire to quit, which suggests a substantial market potential for de-addiction solutions. This heightened health consciousness is further fueled by public health campaigns and educational initiatives that emphasize the benefits of quitting. Consequently, the Nicotine De-addiction Product Market is likely to experience growth as more consumers seek out products that can assist them in overcoming their addiction.

Supportive Regulatory Frameworks

The establishment of supportive regulatory frameworks is playing a crucial role in shaping the Nicotine De-addiction Product Market. Governments worldwide are increasingly implementing policies aimed at reducing smoking rates, which often include funding for cessation programs and the promotion of nicotine replacement therapies. For example, regulations that mandate health warnings on tobacco products and restrict advertising have contributed to a decline in smoking prevalence. This regulatory support not only encourages smokers to seek help but also fosters a favorable environment for the development and marketing of de-addiction products. As these frameworks continue to evolve, the Nicotine De-addiction Product Market is likely to benefit from enhanced visibility and acceptance of cessation solutions.

Growing Demand for Natural and Herbal Products

There is a noticeable shift towards natural and herbal products within the Nicotine De-addiction Product Market, as consumers increasingly seek alternatives to synthetic solutions. This trend is driven by a desire for safer and more holistic approaches to quitting smoking. Research indicates that products containing herbal ingredients, such as lobelia and St. John's Wort, are gaining popularity among those looking to reduce nicotine dependence. The market for these natural alternatives is expanding, as consumers become more health-conscious and wary of chemical additives. Consequently, the Nicotine De-addiction Product Market is likely to see a rise in the availability and variety of natural cessation aids, catering to this growing consumer preference.

Increased Investment in Research and Development

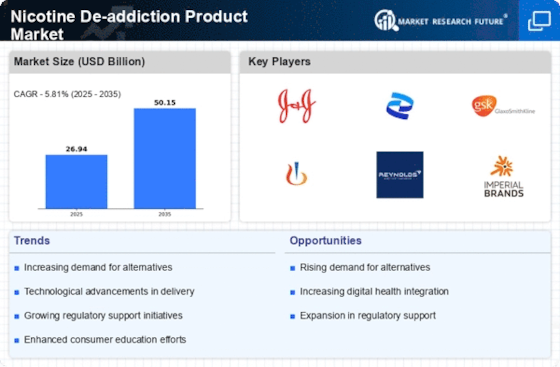

Investment in research and development is a significant driver of innovation within the Nicotine De-addiction Product Market. Pharmaceutical companies and startups are increasingly allocating resources to develop new and improved cessation products, including prescription medications and over-the-counter solutions. This focus on R&D is essential for addressing the diverse needs of smokers and enhancing the efficacy of existing products. Data suggests that the market for nicotine replacement therapies is projected to grow at a compound annual growth rate of 5% over the next five years, indicating a robust interest in developing effective solutions. As R&D efforts continue to advance, the Nicotine De-addiction Product Market is poised for growth, driven by the introduction of novel and effective cessation options.

Technological Advancements in Cessation Products

Technological innovations are transforming the Nicotine De-addiction Product Market, offering new and more effective solutions for individuals seeking to quit smoking. The integration of mobile applications, wearable devices, and online support platforms has enhanced the accessibility and effectiveness of cessation aids. For instance, studies indicate that users of digital cessation programs are 50% more likely to quit compared to those who do not utilize such technologies. This trend suggests that the market is evolving to meet the needs of tech-savvy consumers who prefer personalized and interactive approaches to quitting. As technology continues to advance, the Nicotine De-addiction Product Market is expected to expand, driven by the demand for innovative solutions.