Integration of Smart Grids

The integration of smart grids is a pivotal driver for the Smart Power Distribution System Market. Smart grids facilitate real-time monitoring and management of electricity distribution, which enhances operational efficiency. The market for smart grid technologies is projected to reach substantial figures, with estimates suggesting a growth rate of over 20% annually. This integration allows for better demand response capabilities and improved reliability of power supply. As utilities and energy providers increasingly adopt smart grid technologies, the Smart Power Distribution System Market is likely to see a corresponding rise in demand for advanced distribution systems that can seamlessly integrate with these smart infrastructures.

Rising Adoption of Electric Vehicles

The rising adoption of electric vehicles (EVs) is significantly influencing the Smart Power Distribution System Market. As the number of EVs on the road increases, there is a corresponding need for efficient power distribution systems to support charging infrastructure. The EV market is expected to grow exponentially, with projections indicating that by 2030, electric vehicles could account for a substantial percentage of total vehicle sales. This shift necessitates the development of smart power distribution systems that can manage the increased load and ensure reliable service. Consequently, the Smart Power Distribution System Market is likely to expand in response to this growing demand.

Government Initiatives and Incentives

Government initiatives and incentives play a crucial role in propelling the Smart Power Distribution System Market forward. Various governments are implementing policies aimed at promoting the adoption of smart power distribution technologies. These initiatives often include financial incentives, tax breaks, and grants for companies investing in smart energy solutions. For instance, certain regions have allocated billions in funding to support the transition to smart energy systems. Such governmental support not only encourages innovation but also enhances market confidence, leading to increased investments in the Smart Power Distribution System Market.

Increasing Demand for Energy Efficiency

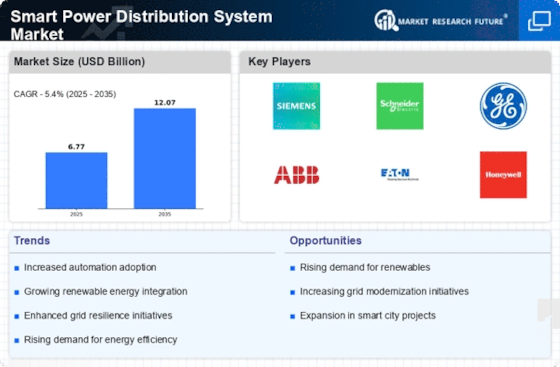

The Smart Power Distribution System Market is experiencing a notable surge in demand for energy efficiency solutions. As energy costs continue to rise, consumers and businesses alike are seeking ways to optimize their energy consumption. This trend is further fueled by regulatory frameworks that promote energy-saving technologies. According to recent data, energy efficiency measures could potentially reduce energy consumption by up to 30% in certain sectors. Consequently, the Smart Power Distribution System Market is poised to benefit from innovations that enhance energy management and reduce waste, thereby appealing to a broader audience concerned with sustainability and cost-effectiveness.

Technological Advancements in Energy Storage

Technological advancements in energy storage are emerging as a key driver for the Smart Power Distribution System Market. Innovations in battery technology, such as lithium-ion and solid-state batteries, are enhancing the efficiency and capacity of energy storage systems. These advancements enable better integration of renewable energy sources and improve grid stability. The energy storage market is projected to witness significant growth, with estimates suggesting a compound annual growth rate of over 25% in the coming years. As energy storage solutions become more viable, the Smart Power Distribution System Market is expected to benefit from increased investments and the development of more sophisticated distribution systems.