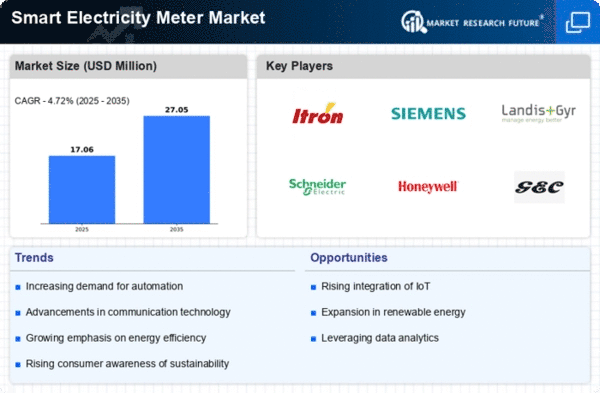

Market Growth Projections

The Global Smart Electricity Meter Market Industry is poised for substantial growth, with projections indicating a market value of 10.7 USD Billion in 2024 and an anticipated increase to 22.6 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate (CAGR) of 7.02% from 2025 to 2035, highlighting the increasing adoption of smart metering technologies across various regions. The market dynamics are influenced by factors such as technological advancements, regulatory support, and rising consumer awareness. These projections suggest a robust future for the industry, driven by the ongoing transition towards smarter energy management solutions.

Growing Demand for Energy Efficiency

The Global Smart Electricity Meter Market Industry is experiencing a surge in demand driven by the increasing emphasis on energy efficiency. Governments worldwide are implementing policies that encourage the adoption of smart meters to reduce energy consumption and enhance grid reliability. For instance, the European Union has set ambitious targets for energy savings, which are likely to propel the market forward. The market is projected to reach 10.7 USD Billion in 2024, reflecting a growing recognition of the need for sustainable energy solutions. This trend indicates a shift towards smarter energy management practices, which are essential for meeting future energy demands.

Integration of Renewable Energy Sources

The integration of renewable energy sources into the grid is a key driver of the Global Smart Electricity Meter Market Industry. As countries strive to meet their renewable energy targets, smart meters facilitate the efficient management of distributed energy resources. They enable utilities to monitor and balance energy supply and demand effectively, which is essential for maintaining grid stability. The increasing penetration of solar and wind energy necessitates advanced metering solutions that can handle variable energy inputs. This trend is expected to bolster the market, as utilities seek to enhance their capabilities in managing renewable energy integration.

Rising Consumer Awareness and Engagement

Consumer awareness regarding energy consumption and sustainability is on the rise, significantly impacting the Global Smart Electricity Meter Market Industry. As individuals become more conscious of their energy usage, the demand for smart meters that provide detailed consumption data is increasing. This trend is further supported by educational campaigns aimed at promoting energy-saving practices. Utilities are leveraging smart meters to enhance customer engagement, offering insights that empower consumers to make informed decisions about their energy use. This shift in consumer behavior is likely to contribute to the market's growth, aligning with broader sustainability goals.

Government Initiatives and Regulatory Support

Government initiatives and regulatory frameworks are crucial drivers of the Global Smart Electricity Meter Market Industry. Many countries are enacting policies that mandate the installation of smart meters to modernize the energy infrastructure. For example, the United States has introduced various programs to incentivize utilities to adopt smart metering technologies. These initiatives not only support energy conservation efforts but also enhance consumer engagement in energy management. The anticipated compound annual growth rate (CAGR) of 7.02% from 2025 to 2035 underscores the potential for sustained growth in this sector, driven by supportive regulatory environments.

Technological Advancements in Metering Solutions

Technological innovations play a pivotal role in the Global Smart Electricity Meter Market Industry. The integration of advanced technologies such as IoT, AI, and machine learning into metering solutions enhances data accuracy and operational efficiency. These advancements enable utilities to monitor energy usage in real-time, facilitating better demand response strategies. As a result, the market is expected to grow significantly, with projections indicating a value of 22.6 USD Billion by 2035. This growth is indicative of the increasing reliance on technology to optimize energy distribution and consumption, thereby improving overall grid performance.