Regulatory Compliance

Regulatory compliance is a critical driver for the Global Smart Container Market Industry. Governments worldwide are implementing stringent regulations regarding the transportation of goods, particularly in sectors such as pharmaceuticals and food. Smart containers equipped with monitoring technologies help companies comply with these regulations by providing real-time data on temperature, humidity, and other critical factors. This capability not only ensures product safety but also mitigates the risk of penalties associated with non-compliance. As regulations become more complex, the demand for smart containers that facilitate compliance is expected to grow, reinforcing their role in global logistics.

Rising E-commerce Demand

The surge in e-commerce activities globally significantly drives the Global Smart Container Market Industry. As online shopping continues to expand, the need for efficient logistics and supply chain solutions becomes paramount. Smart containers provide enhanced tracking capabilities, ensuring timely deliveries and improved customer experiences. This trend is expected to contribute to the market's growth, with projections indicating a rise to 71.4 USD Billion by 2035. The integration of smart containers into e-commerce logistics not only streamlines operations but also reduces costs associated with delays and mismanagement, thereby appealing to businesses aiming for competitive advantage.

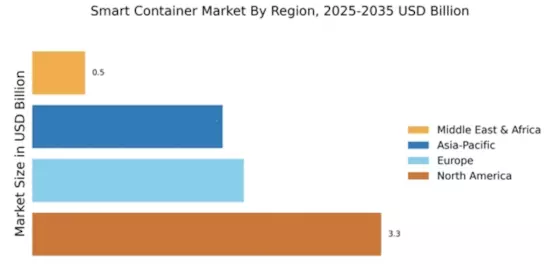

Market Growth Projections

The Global Smart Container Market Industry is poised for substantial growth, with projections indicating a market size of 6.6 USD Billion in 2024 and an anticipated increase to 71.4 USD Billion by 2035. This growth trajectory reflects a robust CAGR of 24.17% from 2025 to 2035, driven by various factors such as technological advancements, rising e-commerce demand, and sustainability initiatives. The increasing adoption of smart container technologies across industries underscores the market's potential, as businesses seek to enhance operational efficiency and meet evolving consumer expectations. This upward trend highlights the critical role of smart containers in shaping the future of global logistics.

Sustainability Initiatives

Sustainability initiatives are increasingly influencing the Global Smart Container Market Industry. Companies are under pressure to adopt eco-friendly practices, and smart containers offer solutions that minimize waste and optimize resource use. For example, smart containers can monitor energy consumption and emissions during transport, helping companies meet regulatory requirements and sustainability goals. This focus on sustainability is likely to drive market growth, as businesses seek to enhance their environmental credentials. The anticipated CAGR of 24.17% from 2025 to 2035 suggests that the demand for sustainable logistics solutions will continue to rise, further embedding smart containers into global supply chains.

Technological Advancements

The Global Smart Container Market Industry is propelled by rapid technological advancements in IoT and sensor technologies. These innovations facilitate real-time tracking and monitoring of goods, enhancing supply chain efficiency. For instance, smart containers equipped with GPS and temperature sensors allow companies to monitor conditions during transit, reducing spoilage and losses. As a result, the market is projected to reach 6.6 USD Billion in 2024, reflecting the growing demand for enhanced logistics solutions. Companies are increasingly adopting these technologies to improve operational efficiency and customer satisfaction, indicating a shift towards more intelligent logistics management.

Increased Investment in Logistics

Increased investment in logistics infrastructure is a significant factor influencing the Global Smart Container Market Industry. Governments and private entities are recognizing the importance of efficient logistics for economic growth and are investing heavily in modernizing supply chains. This investment includes the adoption of smart container technologies that enhance tracking and monitoring capabilities. As logistics networks become more sophisticated, the demand for smart containers is likely to rise, supporting the projected market growth to 71.4 USD Billion by 2035. Enhanced logistics infrastructure not only improves operational efficiency but also fosters competitiveness in the global marketplace.