Smart Cameras Market Type Insights

The Smart Cameras Market segmentation, based on type, includes stand-alone, single-chip, embedded, PC, and network-based. The embedded segment held the majority share in 2021 of the Smart Cameras Market revenue. This is primarily owing to the increasing number of computer vision systems that may be rapidly implemented as embedded systems in IoT due to the wide choice of hardware platforms and the number of open-source libraries for machine learning and artificial intelligence (AI). However, single-chip is the fastest-growing category over the forecast period due to the growing demand for single-chip cameras among consumers.

Smart Cameras Market Sensor Type Insights

The Smart Cameras Market segmentation, based on sensor type, includes CMOS and CCD. The CMOS segment dominated the market in 2021 and is projected to be the faster-growing segment during the forecast period, 2024-2030. This is due to less manufacturing cost of CMOS sensors, less power required to enable smaller cameras, and higher resolution in small pixels. However, CCD is the fastest-growing category over the forecast period.

This is attributed to growing demand in the industrial sector for improved performance, particularly for different applications operating in near-infrared wavelengths, there is the extensive usage of CCD image sensors to avoid the reduction in image sharpness which positively impacts the market growth.

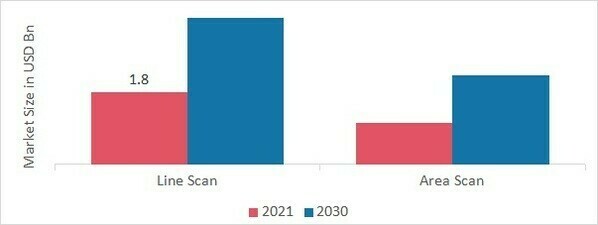

Smart Cameras Market Scanning Type Insights

The Smart Cameras Market data has been bifurcated by scanning type into area scan and line scan. The line scan segment dominated the market in 2021 and is projected to be the faster-growing segment during the forecast period, 2024-2030. This is attributed to the growing demand for line scan smart cameras due to their cost-effectiveness. However, area scan is the fastest-growing category over the forecast period due to the growing demand for area scan cameras among photographers.

Figure 1: Smart Cameras Market by Scanning type, 2021 & 2030 (USD Million)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Smart Cameras Market Application Insights

Based on application, the global smart cameras industry has been segmented into surveillance & security, inspection and quality assurance, automated sorting, transportation & logistics, biometrics and access control, and guidance/machine vision. Surveillance & security held the largest segment share in 2021, owing to the growing penetration of the internet and optimized connectivity, manufacturing plants have shifted from analog to IP cameras. However, transportation & logistics is the fastest-growing category over the forecast period due to the growing demand for smart cameras in the automotive industry.

Smart Cameras Market Connectivity Insights

Based on connectivity, the global smart cameras industry has been segmented into Wi-Fi, Bluetooth, and wireless HART. Wireless HART held the largest segment share in 2021, owing to the significant advancements in home security solutions and IoT, with many homeowners preferring them for effective protection. However, Wi-Fi is the fastest-growing category due to the growing penetration of the internet over the forecast period.