Research Methodology on Smart Appliances Market

1. Introduction

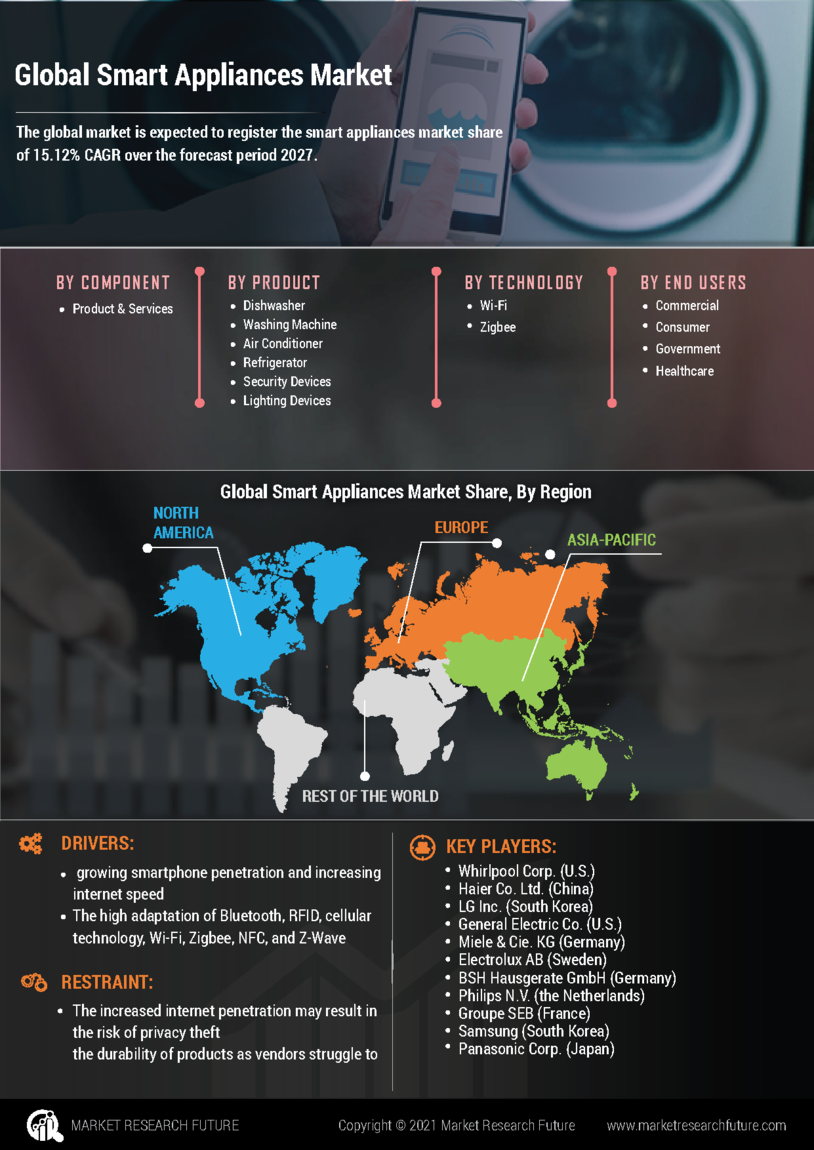

The research methodology adopted for this project has been outlined in this section which aims to provide a comprehensive description and rationale for the research methodology employed for carrying out this report. The market research report aims to provide comprehensive insights into the global smart appliances market, which include an in-depth analysis of the market, its sectionals trends and growth opportunities in the coming years. The data and information used for the report have been collected from different sources such as primary, secondary and other analytical sources.

2. Research Design

The research design employed for this study is a combination of both qualitative and quantitative methodologies. The qualitative research involved combining different sources such as industry experts, and primary, and secondary sources of information. The primary research methods involved interviews with industry experts, market participants and focus groups. The secondary research methods used included market reports and other relevant published literature. This research design enables us to better understand the trend and dynamics of the smart appliance market in the key countries, to identify the key factors driving and affecting the market, and to provide comprehensive insights into the various trends prevalent in the industry.

3. Data Collection

Data is collected from both primary and secondary sources. The primary data is collected through semi-structured interviews conducted with industry experts, market participants and focus groups. 5-6 industry experts were interviewed to gain their opinion and insight into the smart appliance market and its future. Furthermore, a questionnaire was also designed and distributed among market participants from different segments of the market. The secondary data was collected from various sources such as published reports, journals, market reports and other relevant sources.

4. Sampling

A two-stage sampling technique is employed for the collection of data. The first stage of the sampling process involved the identification of potential information sources such as industry experts, market participants, etc. This is done by searching for relevant information sources on the internet and other related sources. The second stage involves interviewing these selected sources and gathering the required data. For the primary data collected, 25 sources were contacted and 5–6 industry experts and relevant market participants were interviewed.

5. Data Analysis

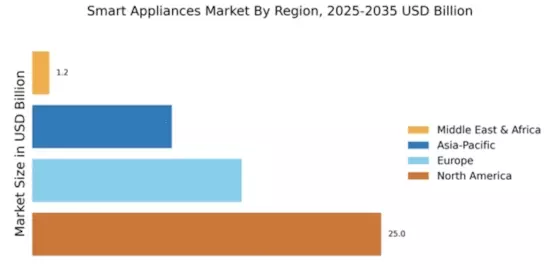

The collected data is analyzed using various processes such as content analysis and statistical analysis. Content analysis was used to analyze the qualitative data collected through the interviews and questionnaires while statistical analysis was used to analyze the quantitative data collected through the secondary sources. The data was also analyzed using statistical techniques such as the chi-square test, t-test, and ANOVA tests among others. The data analysis enables us to draw relevant conclusions and assess the smart appliance market in terms of its size, growth potential, regional trends and other details related to the market.