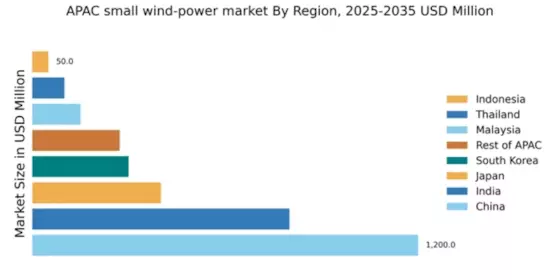

China : Unmatched Growth and Innovation

China holds a commanding 48.5% market share in the APAC small wind-power sector, valued at $1200.0 million. Key growth drivers include robust government policies promoting renewable energy, significant investments in infrastructure, and increasing demand for clean energy solutions. The country’s commitment to reducing carbon emissions has led to favorable regulations and incentives for wind energy projects, fostering a conducive environment for market expansion.

India : Government Support Fuels Growth

India accounts for 31.5% of the APAC small wind market, valued at $800.0 million. The growth is driven by government initiatives like the National Wind-Solar Hybrid Policy and increasing energy demands. Urban areas, particularly in states like Tamil Nadu and Gujarat, are witnessing a surge in small wind installations. The competitive landscape features major players like Suzlon Energy, which is pivotal in driving local manufacturing and innovation.

Japan : Focus on Technology and Sustainability

Japan holds a 15% market share in the small wind sector, valued at $400.0 million. The market is propelled by technological advancements and a strong focus on sustainability. Government incentives for renewable energy and disaster resilience initiatives are key drivers. Urban centers like Tokyo and Osaka are leading in small wind installations, supported by local firms and international players like GE Renewable Energy, enhancing competition and innovation.

South Korea : Strategic Investments and Policies

South Korea represents 11.5% of the APAC small wind market, valued at $300.0 million. The growth is fueled by strategic investments in renewable energy and government policies aimed at achieving carbon neutrality by 2050. Key cities like Busan and Incheon are central to market activities. Major players such as Siemens Gamesa are establishing a strong foothold, contributing to a competitive landscape that encourages innovation and local partnerships.

Malaysia : Government Initiatives Drive Adoption

Malaysia captures 4.5% of the APAC small wind market, valued at $150.0 million. The market is driven by government initiatives promoting renewable energy and increasing awareness of sustainability. Key regions like Sarawak and Sabah are emerging as focal points for small wind projects. The competitive landscape includes local firms and international players, fostering a collaborative environment for technology transfer and innovation.

Thailand : Focus on Local Solutions

Thailand holds a 2.5% market share in the small wind sector, valued at $100.0 million. The growth is supported by government policies aimed at increasing renewable energy capacity and local manufacturing. Regions like Chonburi and Nakhon Ratchasima are key markets for small wind installations. The competitive landscape features local companies and international entrants, creating a dynamic environment for innovation and market growth.

Indonesia : Emerging Market with Challenges

Indonesia accounts for 1.25% of the APAC small wind market, valued at $50.0 million. The market is in its nascent stage, with growth driven by increasing energy demands and government interest in renewable sources. Key areas like Bali and Java are potential hotspots for small wind projects. The competitive landscape is still developing, with opportunities for international players to enter and establish a presence in this emerging market.

Rest of APAC : Regional Variations and Growth Potential

The Rest of APAC holds a 1.1% market share in the small wind sector, valued at $272.04 million. This diverse region showcases varying levels of market maturity and government support for renewable energy. Countries like Vietnam and the Philippines are beginning to explore small wind solutions. The competitive landscape is characterized by a mix of local and international players, creating opportunities for collaboration and innovation in the sector.