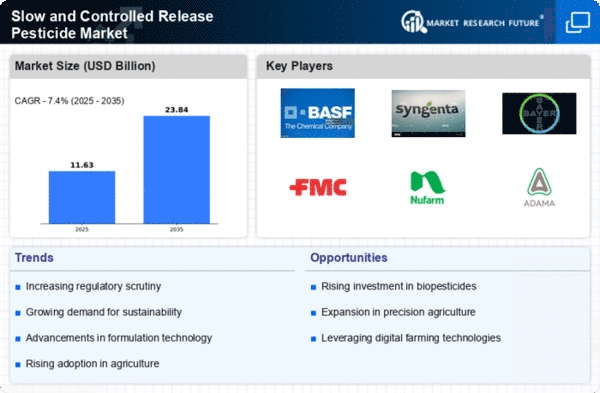

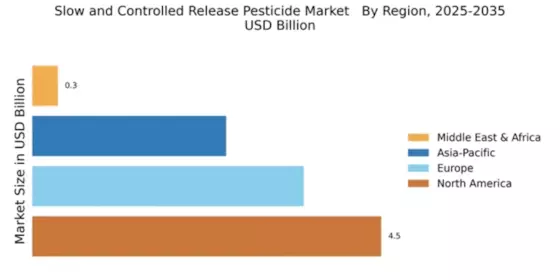

North America : Market Leader in Pesticides

North America is poised to maintain its leadership in the Slow and Controlled Release Pesticide Market, holding a market size of $4.5 billion in 2025. The region's growth is driven by increasing agricultural productivity demands, stringent regulations promoting sustainable practices, and advancements in pesticide formulations. The rising adoption of precision agriculture techniques further fuels demand, ensuring effective pest management while minimizing environmental impact.

The United States stands as the largest market, supported by key players like BASF SE, Bayer AG, and FMC Corporation. These companies are investing in R&D to innovate slow-release formulations that enhance efficacy and reduce application frequency. The competitive landscape is characterized by strategic partnerships and acquisitions, enabling firms to expand their product portfolios and market reach, solidifying North America's position as a global leader in this sector.

Europe : Sustainable Agriculture Focus

Europe's Slow and Controlled Release Pesticide Market is projected to reach $3.5 billion by 2025, driven by a strong emphasis on sustainable agricultural practices and regulatory frameworks aimed at reducing chemical usage. The European Union's Green Deal and Farm to Fork Strategy are pivotal in shaping market dynamics, encouraging the adoption of environmentally friendly pest control solutions. This regulatory support is crucial for fostering innovation in slow-release technologies.

Leading countries such as Germany, France, and the Netherlands are at the forefront of this market, with significant contributions from companies like Syngenta AG and Bayer AG. The competitive landscape is marked by a focus on research and development, with firms striving to meet stringent EU regulations while addressing the growing consumer demand for organic and sustainable products. This trend is expected to enhance market growth and innovation in the region.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region is witnessing significant growth in the Slow and Controlled Release Pesticide Market, projected to reach $2.5 billion by 2025. This growth is primarily driven by increasing agricultural production needs, rising population, and the adoption of modern farming techniques. Countries like India and China are focusing on enhancing crop yields and pest management efficiency, leading to a surge in demand for innovative pesticide solutions that align with sustainable practices.

China and India are the leading markets in this region, with key players such as UPL Limited and Sumitomo Chemical Co., Ltd. actively participating in the market. The competitive landscape is evolving, with local manufacturers emerging alongside global giants, fostering innovation and price competition. As governments promote sustainable agriculture, the demand for slow-release pesticides is expected to rise, further propelling market growth in Asia-Pacific.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa (MEA) region represents an emerging market for Slow and Controlled Release Pesticides, with a market size of $0.33 billion projected for 2025. The growth in this region is driven by increasing agricultural activities, government initiatives to enhance food security, and the need for effective pest management solutions. The region's diverse climate and agricultural practices create a unique demand for tailored pesticide solutions that can address local challenges.

Countries like South Africa and Kenya are leading the way in adopting slow-release technologies, supported by local and international players. The competitive landscape is characterized by a mix of established companies and new entrants, focusing on innovative products that cater to the specific needs of the region. As awareness of sustainable practices grows, the demand for slow-release pesticides is expected to increase, unlocking significant market potential in MEA.