North America : Market Leader in Fertilizers

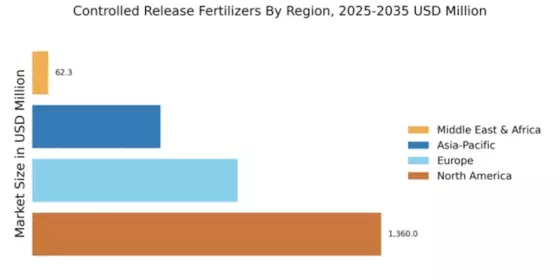

North America is poised to maintain its leadership in the Controlled-Release Fertilizers Market, holding a significant share of 1360.0 million. The region's growth is driven by increasing agricultural productivity demands, technological advancements in fertilizer formulations, and supportive regulatory frameworks. The rising focus on sustainable farming practices further propels the adoption of Controlled-Release fertilizers, enhancing nutrient efficiency and reducing environmental impact. The United States and Canada are the primary contributors to this market, with key players like Nutrien, The Mosaic Company, and Agrium leading the charge. The competitive landscape is characterized by innovation and strategic partnerships aimed at enhancing product offerings. As farmers increasingly seek solutions that optimize yield while minimizing waste, the presence of established companies ensures a robust supply chain and market stability.

Europe : Sustainable Agriculture Focus

Europe's Controlled-Release Fertilizers Market is valued at 800.0 million, driven by stringent environmental regulations and a strong emphasis on sustainable agricultural practices. The European Union's Green Deal and Farm to Fork strategy are pivotal in promoting the use of innovative fertilizers that minimize environmental impact while maximizing crop yield. This regulatory support is crucial for the growth of Controlled-Release fertilizers, aligning with the region's commitment to sustainability. Leading countries such as Germany, France, and the Netherlands are at the forefront of this market, with key players like Yara International and K+S AG actively investing in research and development. The competitive landscape is marked by a shift towards organic and eco-friendly products, catering to the increasing consumer demand for sustainable food sources. This trend is expected to further enhance market growth in the coming years.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region, with a market size of 480.0 million, is witnessing rapid growth in the adoption of Controlled-Release fertilizers. This surge is primarily driven by the increasing need for food security due to rising populations and changing dietary preferences. Governments in countries like India and China are implementing policies to enhance agricultural productivity, which is catalyzing the demand for advanced fertilizer solutions that improve nutrient efficiency and reduce leaching. China and India are the leading countries in this market, with significant investments in agricultural technology and fertilizer innovations. Key players such as Haifa Group and ICL Group are expanding their presence in the region, focusing on tailored solutions that meet local agricultural needs. The competitive landscape is evolving, with a growing emphasis on research and development to create fertilizers that align with sustainable farming practices, ensuring long-term market viability.

Middle East and Africa : Resource-Rich Opportunities

The Middle East and Africa region, with a market size of 82.3 million, presents significant untapped potential for Controlled-Release fertilizers. The agricultural sector is increasingly recognized as a vital component for economic diversification, particularly in countries like South Africa and Morocco. The demand for efficient fertilizers is growing as farmers seek to enhance crop yields in arid and semi-arid climates, where water conservation is critical. Leading countries in this region are focusing on improving agricultural practices and investing in modern fertilizer technologies. The presence of key players like OCP Group and Fertiberia is crucial in driving market growth. The competitive landscape is characterized by a mix of local and international companies, all vying to provide innovative solutions that cater to the unique challenges faced by farmers in this region. As awareness of sustainable practices increases, the market for Controlled-Release fertilizers is expected to expand significantly.