Top Industry Leaders in the Singapore Maritime Sector Market

Singapore Maritime Sector Market

These key players leverage various strategies to maintain their competitive edge. One common approach is continuous innovation in port infrastructure and logistics solutions. PSA International, for instance, focuses on expanding its port facilities and embracing digitalization to enhance efficiency. Similarly, shipping companies invest in modern vessels equipped with advanced technologies to optimize operations and reduce environmental impact.

Strategies Adopted By Key Players Singapore Maritime Sector Market

- PSA International

- ONE (Ocean Network Express)

- PIL (Pacific International Lines)

- AP Moller Singapore Pte Ltd

- Cosco Shipping (Singapore) Petroleum Pte Ltd

- NYK Group

- CMA CGM & ANL (Singapore) PTE LTD

- Evergreen Marine (Singapore) Pte Ltd

- Sea Consortium Private Ltd

- Hin Leong Marine International

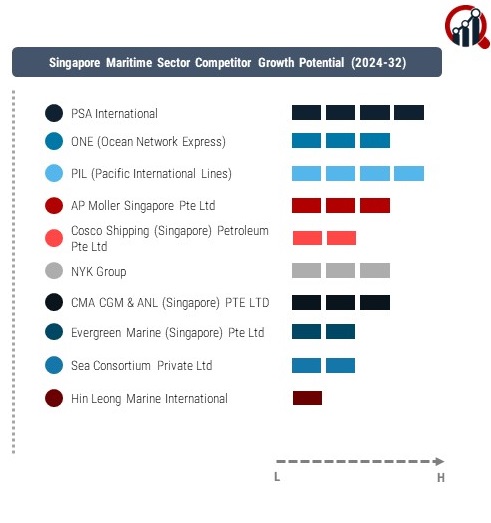

Factors for Market Share Analysis: Several factors contribute to the analysis of market share within Singapore's maritime sector. These include the volume of cargo handled, vessel capacity, route networks, service reliability, and customer satisfaction. Additionally, factors such as financial stability, technological capabilities, and sustainability initiatives also influence market share. Companies with extensive global networks and diversified service offerings often command larger market shares.

New and Emerging Companies: Despite the dominance of established players, new and emerging companies continually enter Singapore's maritime sector, introducing fresh perspectives and innovative solutions. Startups focused on digitalization, sustainable shipping practices, and niche logistics services are gaining traction. For instance, companies like X-Press Feeders and Hafnia are emerging as key players in niche segments such as feeder services and tanker shipping, respectively.

Industry News: Recent industry news reflects Singapore's commitment to maintaining its position as a leading maritime hub. Initiatives such as the Maritime Singapore Green Initiative underscore the sector's focus on sustainability and environmental responsibility. Additionally, collaborations between industry players and government agencies to promote digitalization and talent development demonstrate ongoing efforts to enhance competitiveness and resilience.

Current Company Investment Trends: Investment trends in the Singapore maritime sector reflect a dual focus on infrastructure development and technological innovation. Companies continue to invest heavily in expanding port capacities, enhancing terminal facilities, and upgrading vessel fleets. Moreover, there is a growing emphasis on digital transformation, with investments in data analytics, automation, and blockchain technology to streamline operations and improve efficiency.

Overall Competitive Scenario: Singapore's maritime sector presents a dynamic and competitive landscape characterized by innovation, efficiency, and strategic partnerships. Established players maintain their dominance through continuous investment in infrastructure and technology while adapting to evolving market trends and regulatory requirements. Simultaneously, new entrants and startups contribute to market diversification and innovation, challenging traditional business models and driving industry-wide transformation. The sector's resilience, coupled with Singapore's strategic location and pro-business environment, positions it as a global leader in maritime services for the foreseeable future.

Recent Development:

August 2023, PSA BDP, a prominent provider of integrated supply chain, transportation, and logistics solutions, entered a Memorandum of Understanding (MOU) with Dow Chemical International Pvt. Ltd. (Dow India) to introduce a pioneering sustainable transportation initiative in India. Scheduled to commence in 2024, PSA BDP will introduce electric vehicles for container trucking, facilitating import and export operations through PSA International's (PSA) Mumbai and Ameya terminals, as well as other ports, exclusively for Dow India. These electric trucks will be powered by PSA Mumbai's 6.25MW Open Access Solar Plant, slated for completion later in 2023.

February 2023, A.P. Moller inaugurated a new office in Singapore, signaling an expansion of its investment program across South and Southeast Asia. The firm aims to inject over USD 750 million into regional infrastructure projects. A.P. Moller, a renowned transportation and logistics entity, oversees assets exceeding USD 1.5 billion and has already invested in 16 ventures within the region.