Increased Focus on Product Safety

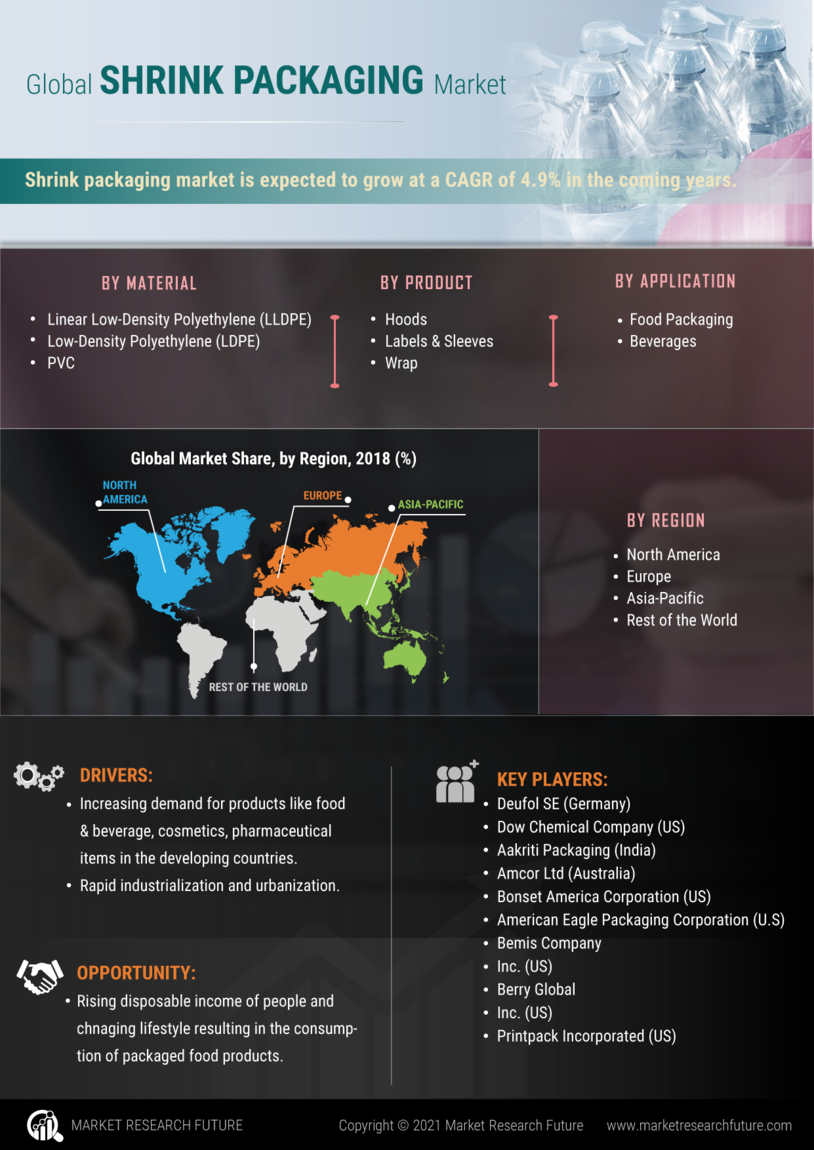

In the Shrink Packaging Market, there is an increasing emphasis on product safety and integrity. As consumers become more health-conscious, the demand for packaging that ensures product protection is on the rise. Shrink packaging provides a reliable solution by offering tamper-evident features that safeguard products from contamination. This is particularly crucial in industries such as pharmaceuticals and food, where safety is paramount. Recent statistics indicate that the food safety packaging market is expected to reach USD 25 billion by 2026, highlighting the growing importance of secure packaging solutions. As a result, manufacturers in the Shrink Packaging Market are likely to invest in advanced materials and technologies that enhance safety features, thereby catering to the heightened consumer expectations for secure and reliable packaging.

Technological Innovations in Packaging

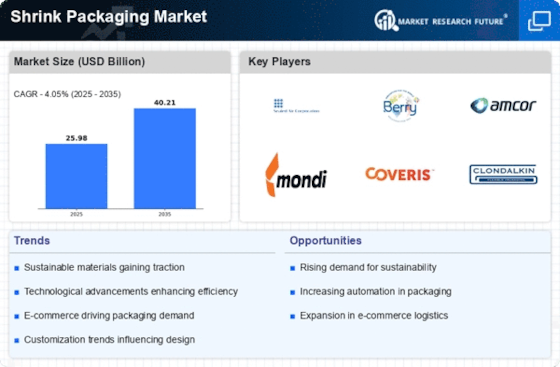

Technological advancements are playing a crucial role in shaping the Shrink Packaging Market. Innovations in materials, machinery, and design are enabling manufacturers to create more efficient and effective packaging solutions. For instance, the development of advanced shrink films that offer superior clarity and strength is enhancing product visibility while ensuring durability. Additionally, automation in packaging processes is streamlining production and reducing costs. Recent market analysis suggests that the packaging machinery market is expected to grow by 4.2% annually, indicating a robust demand for innovative packaging solutions. As technology continues to evolve, the Shrink Packaging Market is likely to benefit from these advancements, allowing companies to meet the diverse needs of consumers while improving operational efficiency.

Rising Demand for Convenience Packaging

The Shrink Packaging Market is experiencing a notable increase in demand for convenience packaging solutions. As consumers prioritize ease of use and portability, manufacturers are adapting their packaging strategies accordingly. This trend is particularly evident in sectors such as food and beverage, where ready-to-eat meals and snack items are gaining popularity. According to recent data, the convenience food sector is projected to grow at a compound annual growth rate of 4.5% over the next five years. Consequently, the Shrink Packaging Market is likely to benefit from this shift, as shrink packaging offers an efficient way to package products while maintaining freshness and extending shelf life. The ability to create tamper-proof seals further enhances consumer confidence, making shrink packaging an attractive option for manufacturers aiming to meet evolving consumer preferences.

Sustainability and Eco-friendly Practices

Sustainability is becoming a key driver in the Shrink Packaging Market as consumers and businesses alike prioritize eco-friendly practices. The shift towards sustainable packaging solutions is evident, with many companies seeking to reduce their environmental footprint. Shrink packaging, particularly when made from recyclable materials, aligns with these sustainability goals. Recent studies indicate that the sustainable packaging market is expected to grow at a CAGR of 5.7% through 2027, reflecting the increasing consumer preference for environmentally responsible products. As a result, manufacturers in the Shrink Packaging Market are likely to invest in innovative materials and processes that minimize waste and enhance recyclability. This focus on sustainability not only meets consumer demands but also positions companies favorably in a competitive market where eco-consciousness is becoming a significant purchasing factor.

Expansion of Retail and E-commerce Channels

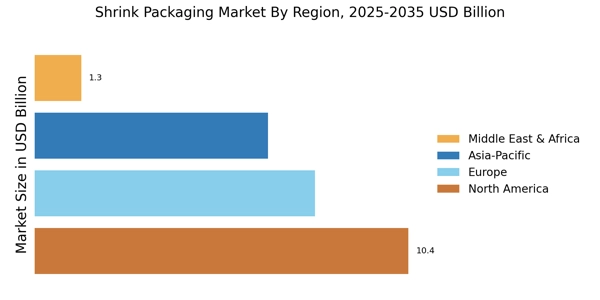

The Shrink Packaging Market is poised for growth due to the expansion of retail and e-commerce channels. As online shopping continues to gain traction, the need for effective packaging solutions that can withstand shipping and handling is becoming increasingly critical. Shrink packaging offers a lightweight and durable option that protects products during transit while also providing an appealing presentation. Recent data suggests that e-commerce sales are projected to reach USD 6 trillion by 2024, indicating a substantial market opportunity for shrink packaging solutions. Retailers are also recognizing the importance of packaging in enhancing brand visibility and consumer engagement. Consequently, the Shrink Packaging Market is likely to see increased demand as businesses seek to optimize their packaging strategies for both in-store and online sales.