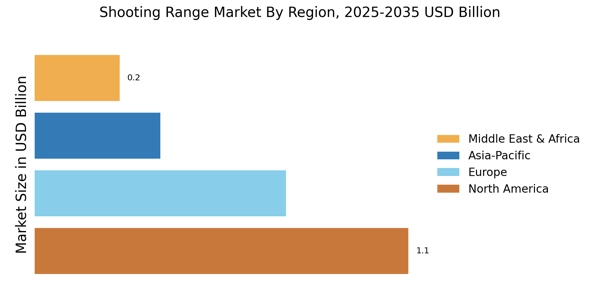

North America : Leading Market for Shooting Ranges

North America is the largest market for shooting ranges, accounting for approximately 45% of the global market share. The region's growth is driven by increasing participation in shooting sports, rising demand for recreational shooting, and supportive regulations that promote firearm training. The U.S. is the primary contributor, followed by Canada, which holds around 10% of the market share. Regulatory frameworks, such as the National Shooting Sports Foundation's initiatives, further bolster market growth.

The competitive landscape in North America is robust, featuring key players like Smith & Wesson, Remington Outdoor Company, and Ruger. These companies dominate the market with their extensive product offerings and strong brand recognition. The presence of numerous shooting ranges and training facilities enhances accessibility for enthusiasts. Additionally, the growing trend of indoor shooting ranges is reshaping the market dynamics, catering to urban populations seeking recreational shooting experiences.

Europe : Emerging Market with Growth Potential

Europe is witnessing a significant rise in the shooting range market, holding approximately 30% of the global share. The growth is fueled by increasing interest in shooting sports, government initiatives promoting firearm safety, and a rise in recreational shooting activities. Countries like Germany and the UK are leading the market, with Germany accounting for about 12% of the share, driven by a strong culture of shooting sports and well-established regulations that support training and safety.

The competitive landscape in Europe features prominent players such as SIG Sauer, Glock, and Beretta. These companies are expanding their presence through strategic partnerships and product innovations. The market is characterized by a mix of traditional outdoor ranges and modern indoor facilities, catering to diverse consumer preferences. Additionally, the European Union's regulations on firearms and shooting sports are shaping the market, ensuring safety and compliance across member states.

Asia-Pacific : Rapid Growth in Shooting Sports

The Asia-Pacific region is emerging as a significant player in the shooting range market, holding around 15% of the global share. The growth is driven by increasing interest in shooting sports, rising disposable incomes, and government initiatives to promote recreational shooting. Countries like Australia and Japan are at the forefront, with Australia accounting for approximately 8% of the market share, supported by a strong culture of hunting and shooting sports.

The competitive landscape in Asia-Pacific is evolving, with key players like Taurus and CZ Group expanding their operations. The region is witnessing a rise in indoor shooting ranges, catering to urban populations. Additionally, the increasing number of shooting competitions and events is fostering interest in the sport, further driving market growth. Regulatory frameworks are also being developed to ensure safety and compliance in shooting activities, contributing to the overall market expansion.

Middle East and Africa : Emerging Market with Unique Challenges

The Middle East and Africa region is gradually developing its shooting range market, holding approximately 10% of the global share. The growth is driven by increasing interest in shooting sports, particularly in countries like the UAE and South Africa. The UAE is the largest market in the region, accounting for about 6% of the share, supported by government initiatives promoting sports and recreational activities. However, regulatory challenges and cultural factors can impact market growth.

The competitive landscape in this region is characterized by a mix of local and international players. Companies are focusing on establishing shooting ranges that cater to both recreational and training needs. The presence of key players is growing, with investments in modern facilities and equipment. Additionally, the region is witnessing an increase in shooting events and competitions, which are helping to raise awareness and interest in shooting sports, contributing to market development.