Consumer Awareness and Education

Consumer awareness and education regarding electric vehicles and their benefits are vital drivers for the Electric Vehicle Range Extender Market. As more information becomes available about the advantages of EVs, including lower operating costs and reduced environmental impact, consumers are more inclined to consider electric options. In 2025, surveys indicate that approximately 70% of potential car buyers are aware of the benefits of electric vehicles, which includes the role of range extenders in alleviating range anxiety. This heightened awareness is likely to translate into increased demand for range extenders, as consumers seek solutions that enhance their EV experience. The Electric Vehicle Range Extender Market must capitalize on this trend by providing educational resources and marketing strategies that highlight the advantages of range extenders.

Government Regulations and Incentives

Government regulations and incentives play a crucial role in shaping the Electric Vehicle Range Extender Market. Many countries are implementing stringent emissions regulations, pushing automakers to adopt cleaner technologies. In 2025, it is anticipated that over 50 countries will have established policies promoting electric vehicle adoption, including subsidies for EV purchases and investments in charging infrastructure. These initiatives not only encourage consumers to switch to electric vehicles but also create a favorable environment for the development of range extenders. As manufacturers respond to regulatory pressures, the Electric Vehicle Range Extender Market is likely to see increased investment and innovation, leading to a wider array of products that enhance the driving experience for consumers.

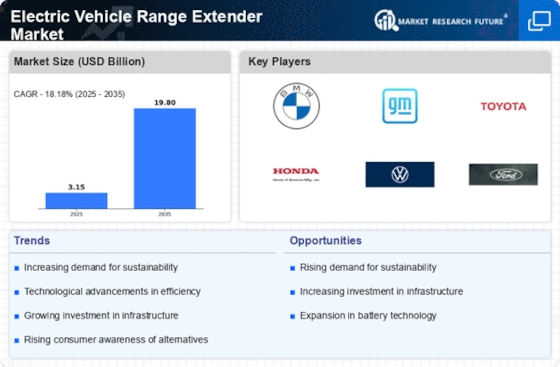

Increasing Demand for Electric Vehicles

The rising demand for electric vehicles (EVs) is a primary driver for the Electric Vehicle Range Extender Market. As consumers become more environmentally conscious, the shift towards EVs has accelerated. In 2025, it is estimated that the number of electric vehicles on the road will surpass 30 million units, creating a substantial need for range extenders. These devices enhance the driving range of EVs, addressing consumer concerns about battery life and charging infrastructure. The Electric Vehicle Range Extender Market is thus positioned to benefit from this trend, as manufacturers seek to provide solutions that alleviate range anxiety. Furthermore, government incentives and policies promoting EV adoption are likely to bolster this demand, making range extenders an essential component of the evolving automotive landscape.

Technological Innovations in Battery Systems

Technological advancements in battery systems are significantly influencing the Electric Vehicle Range Extender Market. Innovations such as solid-state batteries and improved lithium-ion technologies are enhancing energy density and reducing charging times. As these technologies mature, they are expected to integrate with range extenders, providing consumers with more efficient and reliable options. In 2025, the market for advanced battery systems is projected to reach USD 100 billion, indicating a robust growth trajectory. This growth is likely to drive the development of range extenders that complement these advanced battery systems, thereby enhancing the overall performance of electric vehicles. The Electric Vehicle Range Extender Market stands to gain from these innovations, as manufacturers strive to create products that meet the evolving needs of consumers.

Partnerships and Collaborations in the Industry

Partnerships and collaborations among key players in the automotive and technology sectors are emerging as a significant driver for the Electric Vehicle Range Extender Market. As companies recognize the need for innovation and efficiency, they are increasingly forming alliances to develop advanced range extender technologies. In 2025, it is expected that collaborative efforts will lead to the introduction of new products that integrate cutting-edge technologies, such as artificial intelligence and IoT, into range extenders. These partnerships not only enhance product offerings but also streamline production processes, potentially reducing costs. The Electric Vehicle Range Extender Market is likely to benefit from these collaborations, as they foster innovation and accelerate the development of solutions that meet consumer demands.