Growing Regulatory Pressures

Growing regulatory pressures are shaping the Separation Systems for Commercial Biotechnology Industry. Regulatory bodies are imposing stricter guidelines on the production and quality of biopharmaceuticals, necessitating the implementation of reliable separation technologies. In 2025, the regulatory landscape is expected to become even more stringent, with an emphasis on ensuring product safety and efficacy. This trend compels biotechnology companies to invest in advanced separation systems that can meet these regulatory requirements. The need for compliance with Good Manufacturing Practices (GMP) and other quality assurance standards drives the demand for high-performance separation technologies. As companies navigate these regulatory challenges, the Separation Systems for Commercial Biotechnology Industry is likely to see increased investment in technologies that ensure compliance and enhance product quality.

Rising Demand for Biopharmaceuticals

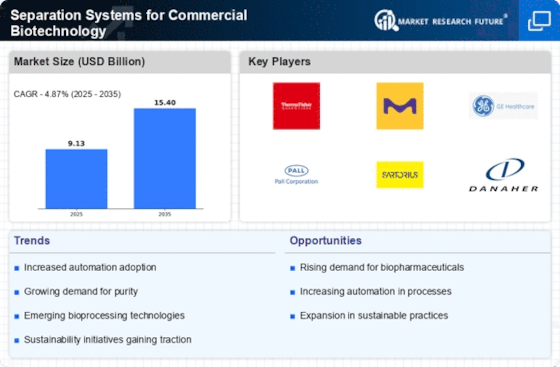

The increasing demand for biopharmaceuticals is a primary driver for the Separation Systems for Commercial Biotechnology Industry. As the healthcare sector continues to evolve, the need for effective and efficient separation technologies becomes paramount. In 2025, the biopharmaceutical market is projected to reach approximately 500 billion USD, indicating a robust growth trajectory. This surge necessitates advanced separation systems to isolate and purify biologics, ensuring product quality and compliance with stringent regulatory standards. The ability to scale up production while maintaining high purity levels is crucial, thus driving innovation in separation technologies. Companies are investing in novel separation methods, such as membrane filtration and chromatography, to meet these demands. Consequently, the Separation Systems for Commercial Biotechnology Industry is likely to experience significant growth as it adapts to the evolving landscape of biopharmaceutical production.

Innovations in Separation Technologies

Innovations in separation technologies are reshaping the Separation Systems for Commercial Biotechnology Industry. The advent of new materials and techniques, such as advanced chromatography and membrane technologies, enhances the efficiency and effectiveness of separation processes. For instance, the introduction of high-performance liquid chromatography (HPLC) has revolutionized the purification of complex biomolecules. In 2025, the market for chromatography systems is expected to grow at a compound annual growth rate (CAGR) of 6.5%, reflecting the increasing reliance on sophisticated separation methods. These innovations not only improve yield and purity but also reduce operational costs, making them attractive to biotechnology firms. As research and development efforts continue to focus on optimizing separation processes, the industry is poised for substantial advancements, further driving the demand for cutting-edge separation systems.

Increased Focus on Process Optimization

The increased focus on process optimization within the biotechnology sector significantly influences the Separation Systems for Commercial Biotechnology Industry. Companies are striving to enhance productivity and reduce costs, leading to a greater emphasis on refining separation processes. In 2025, it is estimated that The Separation Systems for Commercial Biotechnology will invest over 20 billion USD in process optimization technologies. This investment is likely to drive the adoption of advanced separation systems that can streamline workflows and improve overall efficiency. By integrating automation and real-time monitoring into separation processes, biotechnology firms can achieve higher throughput and better quality control. As a result, the demand for innovative separation solutions that facilitate process optimization is expected to rise, positioning the industry for continued growth and development.

Sustainability and Environmental Considerations

Sustainability and environmental considerations are becoming increasingly important in the Separation Systems for Commercial Biotechnology Industry. As the biotechnology sector faces pressure to reduce its environmental footprint, there is a growing demand for eco-friendly separation technologies. In 2025, it is anticipated that the market for sustainable separation solutions will expand significantly, driven by the need for greener processes. Companies are exploring innovative methods, such as bioprocessing and the use of renewable resources, to minimize waste and energy consumption. This shift towards sustainability not only aligns with global environmental goals but also enhances the marketability of biopharmaceutical products. As a result, the Separation Systems for Commercial Biotechnology Industry is likely to experience a surge in demand for sustainable separation technologies that contribute to a more environmentally responsible biotechnology sector.