Emergence of 5G Technology

The rollout of 5G technology is poised to have a profound impact on the Semiconductor IC Packaging Materials Market. As telecommunications infrastructure evolves to support higher data rates and lower latency, the demand for advanced semiconductor packaging solutions is expected to increase. The 5G market is anticipated to reach over 700 billion USD by 2025, driving the need for materials that can handle the complexities of high-frequency applications. This shift presents a significant opportunity for the Semiconductor IC Packaging Materials Market to innovate and adapt to the requirements of next-generation communication technologies.

Advancements in Automotive Electronics

The Semiconductor IC Packaging Materials Market is significantly influenced by the advancements in automotive electronics. With the automotive sector increasingly adopting electronic components for safety, navigation, and entertainment systems, the demand for high-performance packaging materials is likely to rise. The automotive electronics market is expected to reach approximately 300 billion USD by 2025, indicating a robust growth trajectory. This trend necessitates innovative packaging solutions that can withstand harsh environments while ensuring reliability, thus driving the Semiconductor IC Packaging Materials Market.

Rising Demand for Consumer Electronics

The Semiconductor IC Packaging Materials Market is experiencing a surge in demand driven by the increasing consumption of consumer electronics. As devices such as smartphones, tablets, and wearables become ubiquitous, the need for efficient and reliable semiconductor packaging materials intensifies. In 2025, the consumer electronics sector is projected to account for a substantial portion of the semiconductor market, with estimates suggesting a value exceeding 400 billion USD. This growth necessitates advanced packaging solutions that enhance performance and miniaturization, thereby propelling the Semiconductor IC Packaging Materials Market forward.

Growth of Internet of Things (IoT) Devices

The proliferation of Internet of Things (IoT) devices is a key driver for the Semiconductor IC Packaging Materials Market. As more devices become interconnected, the demand for efficient and compact semiconductor packaging solutions is likely to escalate. By 2025, the IoT market is projected to surpass 1 trillion USD, creating a substantial opportunity for packaging materials that support miniaturization and enhanced functionality. This trend underscores the necessity for innovative packaging technologies that can accommodate the unique requirements of IoT applications, thereby fostering growth in the Semiconductor IC Packaging Materials Market.

Focus on Energy Efficiency and Sustainability

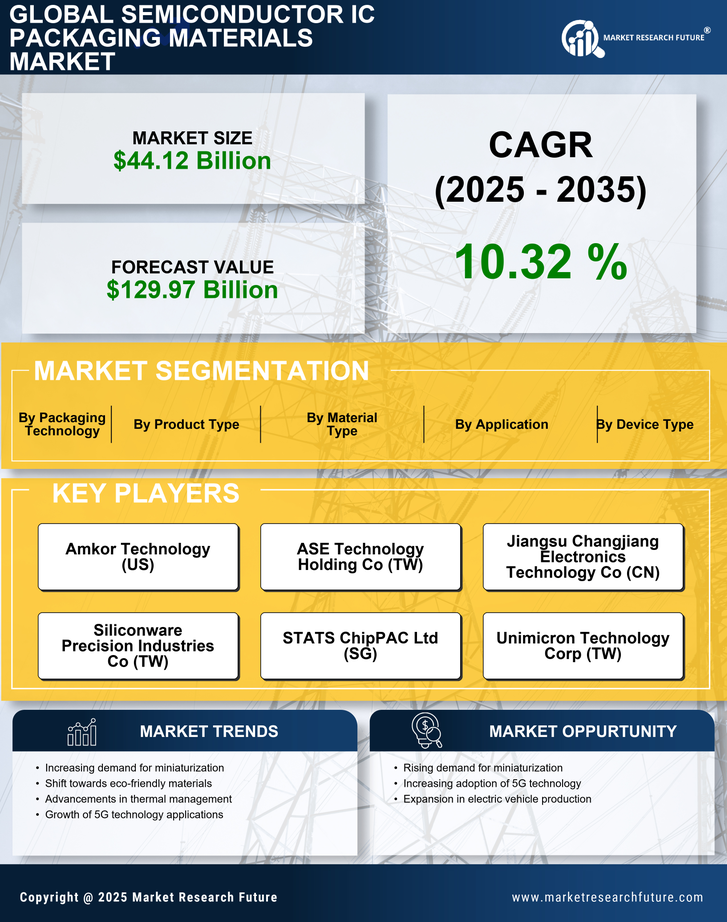

The Semiconductor IC Packaging Materials Market is increasingly influenced by the focus on energy efficiency and sustainability. As industries strive to reduce their carbon footprint, there is a growing demand for eco-friendly packaging materials that minimize environmental impact. The market for sustainable semiconductor packaging solutions is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% through 2025. This trend not only aligns with The Semiconductor IC Packaging Materials Industry, as manufacturers seek to develop greener alternatives.