Self Adhesive Labels Size

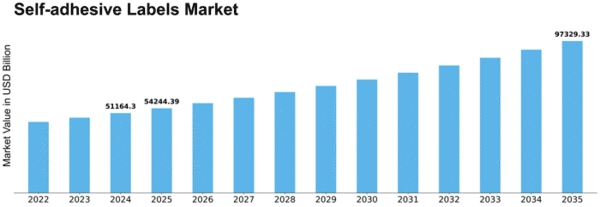

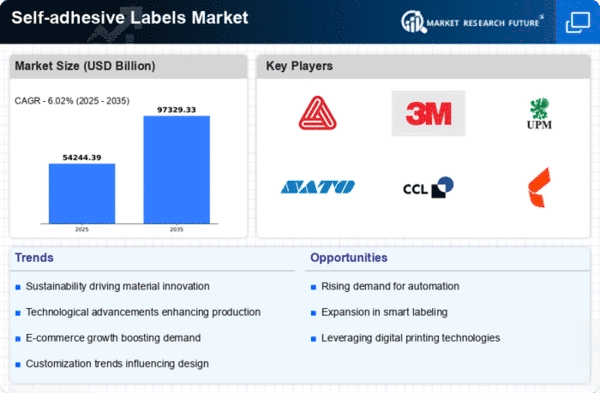

Self-adhesive Labels Market Growth Projections and Opportunities

The self-adhesive labels market is driven by various market factors that shape its growth and evolution. One of the primary factors contributing to the expansion of this market is the increasing demand across various industries for labeling solutions that offer convenience, efficiency, and versatility. Self-adhesive labels, also known as pressure-sensitive labels, are widely preferred by manufacturers due to their ease of application, compatibility with a wide range of surfaces, and ability to accommodate various printing and decorative techniques. This versatility makes self-adhesive labels suitable for a diverse range of products, including consumer goods, food and beverages, pharmaceuticals, cosmetics, and industrial products, driving their adoption across different sectors.

Self-adhesive labels are normally used to fix on packaging. These labels show the essential information about the product. They are also used for decorative purposes to grasp the attention and attract consumers. These labels are multifaceted systems, and contain information printed on the surface. Self-adhesive Labels are made up of three layers, namely release liner, a layer of adhesive, and the face material.

Furthermore, the growing trend of product customization and branding strategies adopted by companies to differentiate their products in the market is fueling the demand for self-adhesive labels. Manufacturers are increasingly focusing on creating visually appealing and unique label designs that resonate with consumers and enhance brand recognition. Self-adhesive labels offer flexibility in terms of design, color, shape, and size, allowing companies to create customized labels that reflect their brand identity and messaging. Additionally, advancements in printing technologies such as digital printing and flexographic printing enable high-quality, cost-effective customization of self-adhesive labels, further driving their popularity among brand owners and manufacturers.

Moreover, the stringent regulatory requirements imposed by governments and industry bodies for labeling and product identification purposes are driving the demand for self-adhesive labels. Regulatory compliance is essential across various industries, including food and beverages, pharmaceuticals, and healthcare, where accurate and clear labeling is crucial for ensuring product safety, traceability, and consumer information. Self-adhesive labels with features such as barcodes, QR codes, product information, and warning labels help manufacturers meet regulatory standards and provide essential information to consumers, enhancing transparency and compliance with labeling regulations.

Additionally, the increasing adoption of automation and digitalization in manufacturing processes is driving the demand for self-adhesive labels. With the rise of Industry 4.0 and smart manufacturing initiatives, manufacturers are seeking labeling solutions that integrate seamlessly with automated packaging and labeling equipment. Self-adhesive labels are well-suited for automated labeling systems due to their ease of application and compatibility with high-speed labeling machines. This trend is particularly evident in industries such as logistics, e-commerce, and retail, where efficient labeling and tracking of products are essential for inventory management, supply chain optimization, and order fulfillment.

Furthermore, the growing emphasis on sustainability and environmental conservation is influencing the self-adhesive labels market. Manufacturers and consumers are increasingly concerned about the environmental impact of packaging materials and are seeking sustainable alternatives. Self-adhesive labels made from eco-friendly materials such as recycled paper, biodegradable films, and compostable adhesives are gaining traction as companies strive to reduce their carbon footprint and meet sustainability goals. Additionally, initiatives promoting recycling and circular economy practices are driving the adoption of self-adhesive labels that are compatible with recycling processes and support the closed-loop recycling of packaging materials.

Leave a Comment