Increasing Cybersecurity Threats

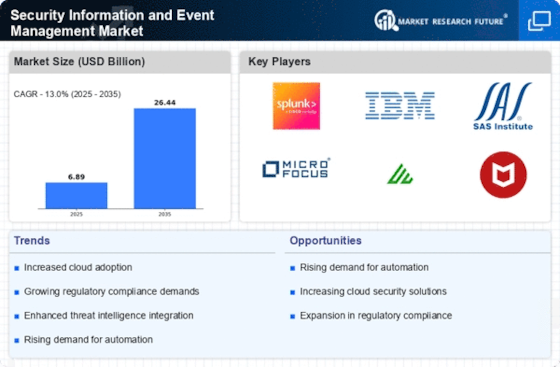

The rise in cybersecurity threats is a primary driver for the Security Information and Event Management Market. Organizations are increasingly facing sophisticated cyber attacks, which necessitate robust security measures. According to recent data, the number of reported cyber incidents has surged, prompting businesses to invest in advanced security solutions. This trend indicates a growing recognition of the importance of real-time monitoring and incident response capabilities. As threats evolve, the demand for comprehensive security information and event management systems that can analyze vast amounts of data in real-time is likely to increase. Consequently, organizations are prioritizing investments in SIEM solutions to enhance their security posture and mitigate risks associated with data breaches.

Regulatory Compliance Requirements

Regulatory compliance is a significant driver for the Security Information and Event Management Market. Organizations are compelled to adhere to various regulations, such as GDPR and HIPAA, which mandate stringent data protection measures. Failure to comply with these regulations can result in severe penalties and reputational damage. As a result, businesses are increasingly adopting SIEM solutions to ensure compliance and streamline reporting processes. The market for SIEM is projected to grow as organizations seek to automate compliance-related tasks and maintain audit trails. This trend underscores the necessity for effective security management systems that can facilitate compliance while providing insights into security incidents and vulnerabilities.

Integration of Advanced Analytics and AI

The integration of advanced analytics and artificial intelligence is a transformative driver for the Security Information and Event Management Market. Organizations are increasingly leveraging AI and machine learning to enhance their security operations. These technologies enable the analysis of large datasets, identifying patterns and anomalies that may indicate security threats. The market is witnessing a shift towards intelligent SIEM solutions that can automate threat detection and response processes. This trend is likely to improve the efficiency of security teams and reduce response times to incidents. As organizations seek to bolster their defenses against evolving threats, the incorporation of advanced analytics into SIEM systems is expected to play a crucial role in shaping the future of security management.

Adoption of Cloud-Based Security Solutions

The shift towards cloud-based security solutions is reshaping the Security Information and Event Management Market. Organizations are increasingly migrating their operations to the cloud, which necessitates the implementation of cloud-compatible SIEM systems. This transition allows for enhanced scalability, flexibility, and cost-effectiveness in security management. Market data suggests that the demand for cloud-based SIEM solutions is on the rise, as they offer real-time analytics and centralized monitoring capabilities. Furthermore, the ability to integrate with other cloud services enhances the overall security framework. As more businesses recognize the benefits of cloud technology, the adoption of cloud-based SIEM solutions is expected to accelerate, driving growth in the market.

Growing Demand for Incident Response Capabilities

The growing demand for effective incident response capabilities is a key driver for the Security Information and Event Management Market. Organizations are increasingly recognizing the importance of having a well-defined incident response plan to address security breaches promptly. The need for rapid detection and response to incidents is paramount, as delays can lead to significant financial losses and reputational harm. Market trends indicate that businesses are investing in SIEM solutions that offer comprehensive incident response features, including automated workflows and real-time alerts. This focus on incident response is likely to drive the adoption of SIEM systems, as organizations strive to enhance their resilience against cyber threats and ensure business continuity.