Increased Regulatory Requirements

The Secure Logistics Market is significantly influenced by the rise in regulatory requirements aimed at enhancing security standards across various sectors. Governments and regulatory bodies are imposing stricter guidelines to ensure the safety of goods in transit, particularly in industries such as pharmaceuticals and electronics. Compliance with these regulations often necessitates investment in secure logistics solutions, which can be costly but essential for maintaining market access. For example, the implementation of the Customs-Trade Partnership Against Terrorism (C-TPAT) program has led to increased scrutiny of supply chain security practices. As a result, companies are compelled to adopt secure logistics practices to comply with these regulations, thereby driving growth within the Secure Logistics Market.

Focus on Risk Management Strategies

The Secure Logistics Market is increasingly focusing on risk management strategies as businesses recognize the importance of safeguarding their assets. The rise in global trade and the complexity of supply chains have heightened the potential for disruptions, prompting companies to adopt proactive measures. Risk management in logistics involves identifying vulnerabilities and implementing strategies to mitigate them, such as diversifying suppliers and enhancing security protocols. According to industry reports, organizations that invest in risk management can reduce their operational costs by up to 20%. This focus on risk management not only protects assets but also enhances customer trust, which is vital in the Secure Logistics Market. As companies strive for resilience, the demand for secure logistics solutions is expected to grow.

Emerging Markets and Economic Growth

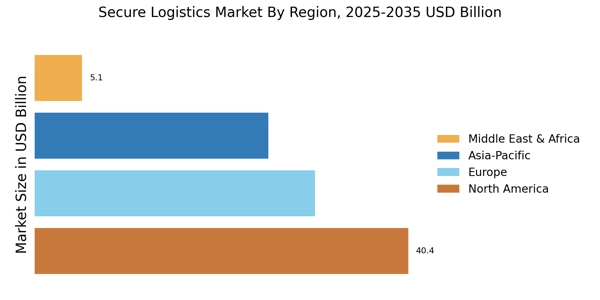

The Secure Logistics Market is poised for expansion due to emerging markets and overall economic growth. As economies develop, there is a corresponding increase in trade activities, necessitating secure logistics solutions to manage the flow of goods. Countries in Asia and Africa are experiencing rapid industrialization, leading to a surge in demand for secure transportation and storage services. The logistics market in these regions is projected to grow significantly, with estimates suggesting a CAGR of 10% over the next five years. This growth presents opportunities for companies within the Secure Logistics Market to establish a presence in these burgeoning markets. As businesses seek to capitalize on economic growth, the demand for secure logistics services will likely increase, driving innovation and investment in the sector.

Rising Demand for Secure Supply Chains

The Secure Logistics Market is witnessing an increasing demand for secure supply chains, driven by the need to protect sensitive information and high-value goods. Companies are prioritizing security measures to mitigate risks associated with theft, fraud, and cyberattacks. According to recent data, The Secure Logistics Market is expected to grow at a CAGR of 7.5% from 2023 to 2028. This growth reflects a heightened awareness of the vulnerabilities within supply chains and the necessity for robust security protocols. As businesses expand their operations internationally, the complexity of logistics increases, necessitating enhanced security measures. Consequently, the Secure Logistics Market is adapting to these demands by implementing comprehensive security solutions that ensure the safe transit of goods.

Technological Integration in Secure Logistics

The Secure Logistics Market is experiencing a notable shift due to the integration of advanced technologies such as IoT, AI, and blockchain. These technologies enhance tracking, monitoring, and security of goods in transit. For instance, IoT devices provide real-time data on the location and condition of shipments, which is crucial for maintaining the integrity of sensitive cargo. The market for IoT in logistics is projected to reach USD 75 billion by 2025, indicating a robust growth trajectory. Furthermore, AI algorithms optimize routing and inventory management, reducing costs and improving efficiency. As these technologies become more prevalent, they are likely to redefine operational standards within the Secure Logistics Market, fostering a more secure and efficient supply chain.