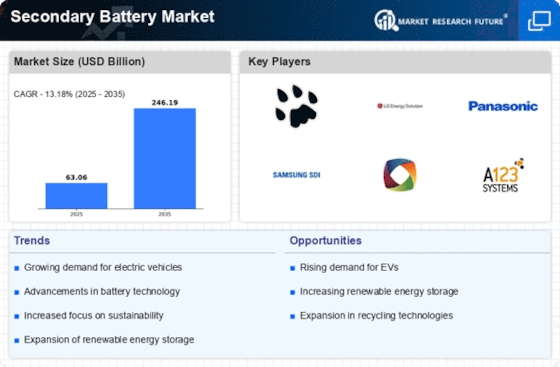

The Secondary Battery Market is currently characterized by intense competition and rapid innovation, driven by the increasing demand for electric vehicles (EVs), renewable energy storage, and portable electronics. Major players such as CATL (China), LG Energy Solution (South Korea), and BYD (China) are at the forefront, each adopting distinct strategies to enhance their market positioning. CATL, for instance, focuses on technological advancements in battery chemistry and production efficiency, while LG Energy Solution emphasizes strategic partnerships with automotive manufacturers to secure long-term supply agreements. These strategies collectively contribute to a dynamic competitive environment, where innovation and collaboration are paramount.

In terms of business tactics, companies are increasingly localizing manufacturing to mitigate supply chain disruptions and optimize logistics. This trend is particularly evident in the Secondary Battery Market, which appears moderately fragmented, with several key players exerting substantial influence. The collective actions of these companies, including investments in regional production facilities and supply chain optimization, are reshaping the market structure, fostering a more resilient and responsive industry.

In August 2025, LG Energy Solution (South Korea) announced a significant investment in a new battery manufacturing facility in the United States, aimed at increasing production capacity to meet the surging demand from local EV manufacturers. This strategic move not only enhances LG's operational capabilities but also aligns with the growing trend of regional supply chains, reducing dependency on overseas production and improving delivery times.

Similarly, in September 2025, BYD (China) unveiled a new line of lithium iron phosphate batteries designed for commercial vehicles, showcasing its commitment to innovation in battery technology. This development is crucial as it positions BYD to capture a larger share of the commercial EV market, which is expected to expand significantly in the coming years. The introduction of these batteries reflects a broader industry shift towards more sustainable and efficient energy solutions.

In October 2025, Panasonic (Japan) announced a partnership with a leading renewable energy firm to develop integrated energy storage systems that leverage its advanced battery technology. This collaboration underscores the growing importance of sustainability in the Secondary Battery Market, as companies seek to align their products with environmental goals and consumer preferences. Such partnerships are likely to enhance Panasonic's competitive edge by diversifying its product offerings and expanding its market reach.

As of October 2025, the competitive landscape is increasingly defined by trends such as digitalization, sustainability, and the integration of artificial intelligence in battery management systems. Strategic alliances are becoming more prevalent, enabling companies to pool resources and expertise to drive innovation. Looking ahead, it is anticipated that competitive differentiation will evolve, shifting from traditional price-based competition to a focus on technological advancements, sustainability, and supply chain reliability. This transition may redefine the parameters of success in the Secondary Battery Market, emphasizing the need for agility and forward-thinking strategies.