Increasing Use in Lightweight Alloys

The Scandium Metal Market is experiencing a notable increase in the utilization of scandium in lightweight alloys, particularly in the aerospace and automotive sectors. Scandium enhances the strength-to-weight ratio of aluminum alloys, making them more desirable for manufacturers aiming to improve fuel efficiency and performance. As the demand for lightweight materials rises, particularly in the context of stringent environmental regulations, the incorporation of scandium is likely to become more prevalent. Recent estimates suggest that the aerospace sector alone could see a growth rate of approximately 5% annually, driven by the need for advanced materials. This trend indicates a robust future for the Scandium Metal Market, as manufacturers seek to innovate and meet evolving consumer expectations.

Advancements in Fuel Cell Technologies

The Scandium Metal Market is poised for growth due to advancements in fuel cell technologies. Scandium is increasingly recognized for its role in enhancing the performance of solid oxide fuel cells (SOFCs), which are gaining traction as a clean energy solution. The integration of scandium into fuel cell systems can improve efficiency and reduce operating temperatures, making them more viable for commercial applications. As nations strive to transition towards sustainable energy sources, the demand for scandium in this context is expected to rise. Projections indicate that the fuel cell market could expand significantly, potentially reaching a valuation of several billion dollars by the end of the decade, thereby bolstering the Scandium Metal Market.

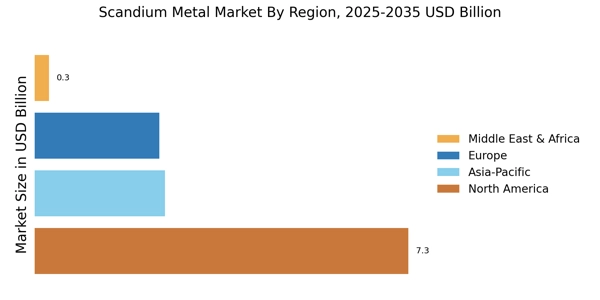

Emerging Markets and Industrial Growth

The Scandium Metal Market is experiencing growth driven by emerging markets, particularly in Asia and South America. As industrialization accelerates in these regions, the demand for advanced materials, including scandium, is expected to rise. Industries such as construction, automotive, and electronics are increasingly recognizing the benefits of scandium-enhanced materials. For instance, the construction sector's growth in these regions could lead to a demand increase of approximately 4% annually for scandium in building materials. This trend suggests that the Scandium Metal Market may see a diversification of its customer base, as new markets emerge and existing industries expand.

Rising Interest in Defense Applications

The Scandium Metal Market is witnessing a surge in interest from the defense sector, where scandium's unique properties are being leveraged for various applications. Scandium alloys are utilized in military aircraft and armored vehicles due to their lightweight and high-strength characteristics. This trend is likely to be fueled by increasing defense budgets and a focus on enhancing the performance of military equipment. Reports suggest that the defense sector could account for a substantial portion of the scandium demand, with projections indicating a compound annual growth rate of around 6% in this segment. As nations prioritize modernization and technological advancements, the Scandium Metal Market stands to benefit significantly.

Technological Innovations in Extraction Processes

The Scandium Metal Market is likely to benefit from technological innovations in extraction processes. Recent advancements in mining and refining techniques are making scandium extraction more economically viable, which could lead to increased production levels. Enhanced extraction methods not only reduce costs but also minimize environmental impacts, aligning with global sustainability goals. As production becomes more efficient, the availability of scandium is expected to rise, potentially lowering prices and stimulating demand across various sectors. Analysts suggest that these innovations could lead to a more competitive landscape within the Scandium Metal Market, fostering growth and attracting new investments.