Urbanization Trends

Urbanization is a significant driver influencing the Scandinavia Construction Market. As populations in urban areas continue to grow, there is an increasing demand for residential and commercial spaces. Recent statistics reveal that urban areas in Norway are projected to expand by 15% over the next decade, necessitating substantial investment in infrastructure and housing. This trend is prompting governments to prioritize urban development projects, which include transportation networks and public amenities. The focus on creating sustainable urban environments is also evident, as cities aim to enhance livability while accommodating growth. Consequently, the construction sector is likely to experience robust growth, driven by the need to meet the demands of an urbanizing population.

Technological Advancements

Technological integration is transforming the Scandinavia Construction Market, enhancing efficiency and productivity. The adoption of Building Information Modeling (BIM) has become prevalent, allowing for improved project visualization and management. Recent data indicates that companies utilizing BIM report a 20% reduction in project delivery times. Additionally, the rise of smart construction technologies, such as drones and IoT devices, is facilitating real-time monitoring and data collection, which can lead to better decision-making. As the industry continues to embrace these advancements, it is expected that operational costs will decrease, while project quality and safety standards will improve. This technological shift not only streamlines processes but also positions the Scandinavia Construction Market as a leader in innovation.

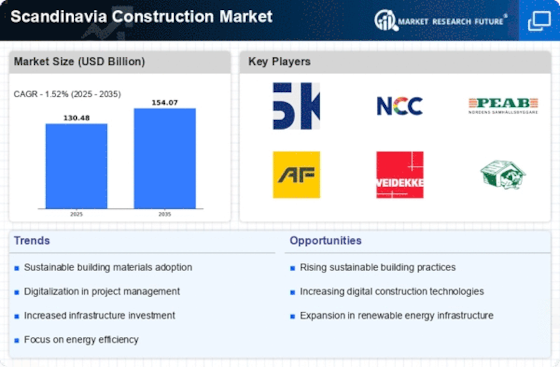

Sustainable Construction Practices

The increasing emphasis on sustainability is a pivotal driver in the Scandinavia Construction Market. Governments across the region are implementing stringent regulations aimed at reducing carbon footprints and promoting eco-friendly building materials. For instance, Sweden has set ambitious targets to achieve net-zero emissions by 2045, which influences construction practices significantly. The market is witnessing a surge in demand for green buildings, with a reported 30% increase in projects utilizing sustainable materials in the last year. This trend not only aligns with environmental goals but also appeals to consumers who are increasingly conscious of their ecological impact. Consequently, the integration of sustainable practices is likely to reshape the construction landscape, fostering innovation and potentially leading to cost savings in the long run.

Regulatory Frameworks and Standards

The regulatory environment plays a pivotal role in shaping the Scandinavia Construction Market. Stringent building codes and safety regulations are being enforced to ensure high standards in construction practices. For instance, Norway has implemented comprehensive regulations aimed at improving energy efficiency in buildings, which has led to a notable increase in energy-efficient construction projects. Compliance with these regulations often necessitates the adoption of advanced technologies and materials, thereby influencing market dynamics. Furthermore, the emphasis on safety standards is likely to drive demand for specialized construction services and training programs. As regulations evolve, they will continue to impact the operational landscape of the construction industry, potentially leading to increased costs but also enhanced quality and safety.

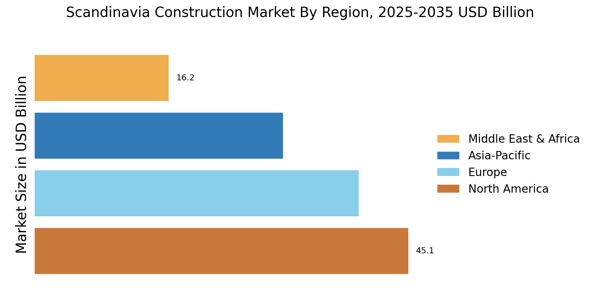

Government Investments in Infrastructure

Government initiatives and investments in infrastructure are crucial drivers of the Scandinavia Construction Market. In recent years, countries like Denmark and Finland have announced substantial funding for infrastructure projects, including transportation, energy, and public facilities. For example, Denmark's government has allocated over 1 billion euros for the development of sustainable transport systems, which is expected to stimulate construction activities significantly. These investments not only create jobs but also enhance the overall economic landscape, fostering a conducive environment for private sector participation. As infrastructure needs continue to evolve, the construction market is poised for growth, driven by public sector commitments to enhance connectivity and sustainability.